How to calculate the lifetime value of a customer

Published August 2022

Published Aug 2022

6 min read

AI Summary

When it comes to the tools in your toolbox of ecommerce metrics, customer lifetime value is among the most important.

When it comes to the tools in your toolbox of ecommerce metrics, customer lifetime value is among the most important. But how exactly can you calculate customer lifetime value—and what are the benefits and potential drawbacks of doing so?

In this post, we’ll dive into everything you need to know about customer lifetime value calculations, how to track this metric effectively to assess the health of your business, and strategies for increasing the lifetime value of your own customers.

What is customer lifetime value (CLV)?

Customer lifetime value, or CLV, is a key business metric that measures the amount of money you can expect your average customer to bring in throughout the duration of their relationship with you. A variety of factors impact your CLV, including:

- Your average order value (AOV)

- The purchase frequency of your average existing customer

- Whether or not your products are offered via subscription

- Your customer retention and churn rates

A higher CLV doesn’t just mean increased revenue for your business—it can often be an indicator of strong customer relationships and high levels of customer satisfaction. Loyal customers can in turn benefit your marketing efforts via positive reviews and word-of-mouth recommendations.

How to calculate customer lifetime value

There are a variety of ways businesses can use for calculating customer lifetime value. At Recharge, we use the following customer lifetime value formula: annual revenue per customer / annual customer churn.

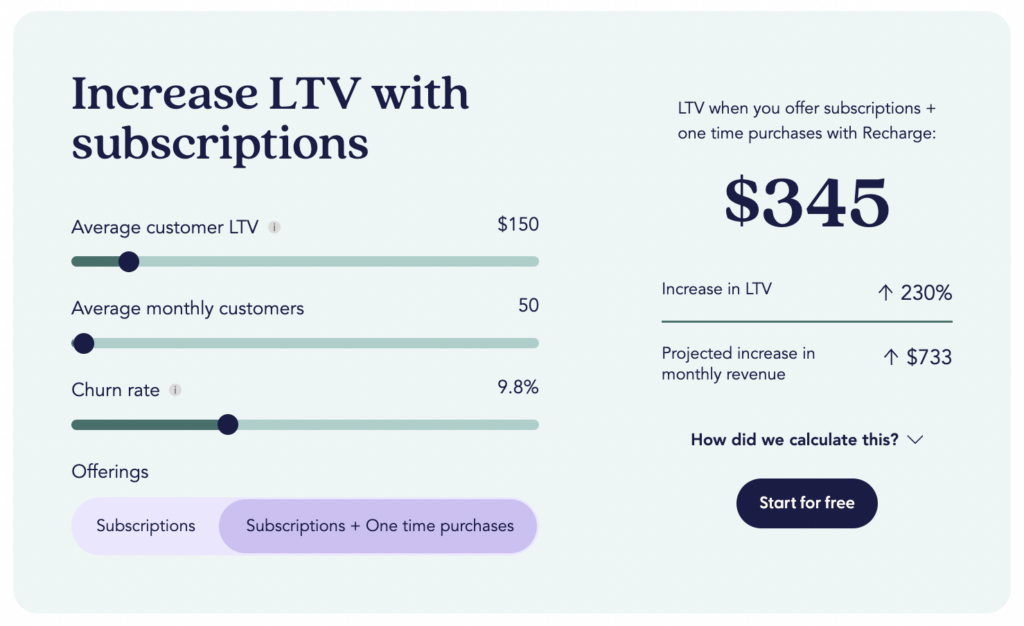

Looking to calculate how much your customer lifetime value can increase when you offer subscriptions? Recharge’s LTV calculator makes it easy for you to see your potential increases in customer lifetime value and monthly revenue when you offer subscriptions, one-time purchase options, or a combination.

Benefits of tracking the customer lifetime value metric

Making a point to regularly measure customer lifetime value allows you to identify patterns and outliers in customer behavior over time. This can empower you to better understand which types of events—for example, a time of year or a particular marketing campaign—trigger increases or decreases in your customer lifetime value. In this way, you can make better business decisions that are informed directly by your customers’ actions and preferences.

To most effectively track your customer lifetime value, be sure to break out your customer base into different customer segments with similar traits. For example, you could track and compare the LTV of your subscription customers against your one-time customers. This can prevent your overall data from being skewed by a small group of particularly high-value customers, allowing you deeper insights into each individual subset of your customer base.

The importance of the LTV:CAC ratio

While customer lifetime value is an important metric, it alone cannot give you a complete picture of the health of your business. Instead, it should always be considered in the context of other metrics, particularly customer acquisition costs. After all, if the amount of money a company spends to bring in new customers exceeds the amount of money those customers bring in, it doesn’t matter how high LTV is.

To measure the relationship between these two metrics, calculate your LTV:CAC ratio (customer lifetime value divided by customer acquisition costs). The lower the ratio, the less profitable the business is. It’s commonly advised that at least 3:1 is a good LTV/CAC ratio, but this all depends on your unique business and industry.

Three tips for increasing the lifetime value of a customer

Looking for tangible ways to increase LTV for your business? Follow these best practices from Recharge’s Succeed with Subscriptions guide to create meaningful shopping experiences for your existing customers.

1. Offer both subscriptions & one-time purchases

Implementing subscriptions is a natural way to increase your LTV, as the business model is recurring in nature and lends itself to long-term customer relationships. For ultimate LTV impact, offer a two-pronged approach with options for both subscriptions and one-time purchases. Our research shows that this combination can increase LTV by up to 230%.

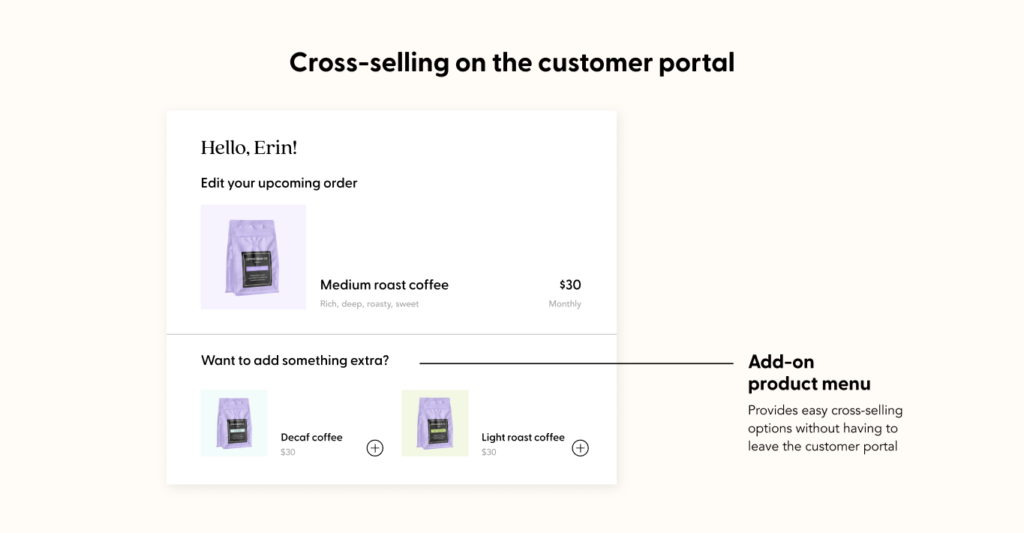

2. Cross-sell & upsell to your customers

Cross-selling and upselling are two separate but related forms of personalized product recommendations. The goal of both strategies is to increase the value of each order, but each one accomplishes this in slightly different ways.

With cross-selling, you can suggest related products for customers to buy in addition to their existing purchase. With upselling, you can suggest a related, more premium product for your customers to upgrade to instead of their existing purchase for a higher price.

Whether you choose one of these strategies, both, or a combination, the key here is to personalize. Recommend products that are relevant and valuable to your customers. In this way, you can increase trust in your recommendations, therefore increasing trust in your brand.

3. Make the shopping experience flexible

To keep your customers with your business for the long haul, create flexible shopping experiences that are adaptable to their lives. Making the customer experience flexible is particularly important if you are a subscription brand, as customers don’t want to be locked in to recurring orders they can’t update to their liking.

To increase LTV by improving the flexibility of your shopping experience, consider the following strategies:

- Allow customers to swap product variants in their order so they can get exactly what they want without having to cancel.

- Empower your customers with a variety of delivery cadences—for example, options for weekly, bi-weekly, or monthly deliveries—so they can always have the right amount of product.

- Allow options for skipping or rescheduling a delivery—this way, if a customer has an excess of product or is going on vacation, they can tailor their order to fit their schedule.

- Optimize your customer portal so customers can easily manage their own subscriptions when they log on to their account.

- Leverage transactional SMS so customers can update their orders straight from their mobile device.

Customer loyalty & lifetime value go hand-in-hand

To increase your customer lifetime value, be your customers’ advocate. Constantly look out for new ways to add value for them and incentivize them to stick with your business for the long haul. When you position your business as a trusted champion of your customers, you’ll not only lay the groundwork for high customer lifetime value, but also for increased brand loyalty and customer retention rates.

Categories