The secret lives of subscribers

It's no secret: We love subscriptions.

A good subscription makes the difference between a customer for a day and a customer for life—and provides the stability that Recharge's 20,000 brands rely on to scale.

That's why we keep a finger on the pulse of subscriptions: how customers engage with them, how their behavior changes, and how valuable subscriptions really are to our brands (spoiler: pretty valuable).

What we're seeing

We watched how our brands' customers shopped over the last year, then compared their tendencies to the year before. Here's what we think you'll find interesting.

Subscribers are your best customers—and getting even better

Our top focus at all times is making subscriptions pivotal to business strategy.

Good news: They still are. The routine economy is thriving. Subscribers are several times as valuable to a brand as non-subscribers, and they're becoming even more valuable in many cases.

The opportunity

Focus on converting new customers to subscriptions (and existing subscribers to more subscriptions) to maximize value.

Flexible subscriptions are the name of the game

Gone are the days of basic set-and-forget, once-a-month shipments. Customers are editing and managing their subscription orders on the fly more freely than ever.

The opportunity

Want to hang on to subscribers? Make sure your subscriptions accommodate them instead of the reverse.

A single subscriber is worth over three non-subscribing customers to a Food & Beverage brand.

Subscriptions make success routine

Loyal subscribers drive the bulk of orders and revenue in virtually every industry Recharge's brands trade in.

Beauty & Personal Care

Food & Beverage

Health & Wellness

Home & Pet

Other

‘22–’23

‘23–’24

Making a list, checking it twice for seasonality

Don't worry, Beauty & Personal Care isn't shedding subscribers—it's just a supremely giftable segment that had an excellent holiday season.

The rest of the year? Prime subscriber time.

Subscribers are shopping more, spending bigger & staying longer

It's hard to overstate this: Subscribers are your best customers, and becoming more valuable by the year.

Order up

Here's something: Every single major industry saw subscribers placing more orders over the last year.

When a brand adds value to a subscriber's day every day, subscribers reward them by incorporating their products into their routines (and placing more orders).

Orders per subscriber

Beauty & Personal Care+13%

Food & Beverage+10.3%

Health & Wellness+21.8%

Home & Pet+17.5%

Other+15.7%

A typical brand's subscribers placed

4.4 orders

+15% over the year before

One-time customers spend more up front—but subscribers' longevity quickly makes them more valuable customers.

The opportunity

Double down on subscriptions

Recharge has always loved subscriptions because they promote customer loyalty, which boosts retention and helps our brands get more out of their acquisition spending.

That isn't changing. In fact, it's becoming even more true. To maximize your potential, focus on converting one-time shoppers to loyal subscribers.

Reward programs

Discounts for subscribing

Curated kits & starter sets

How customers are shopping

Variety is the spice of life

Some subscribers may get hooked by a single great product, but that's rarely where they stop. Many subscribe to 4 or 5, especially when there are lots of delicious flavors to try.

The opportunity

Diversify your catalog. A well-rounded selection means there's more to love—and more to stay subscribed for.

Products per subscriber

Beauty & Personal Care

3.49

Food & Beverage

6.42

Health & Wellness

4.75

Home & Pet

5.44

Other

4.83

Variety is the spice of life

Some subscribers may get hooked by a single great product, but that's rarely where they stop. Many subscribe to 4 or 5, especially when there are lots of delicious flavors to try.

The opportunity

Diversify your catalog. A well-rounded selection means there's more to love—and more to stay subscribed for.

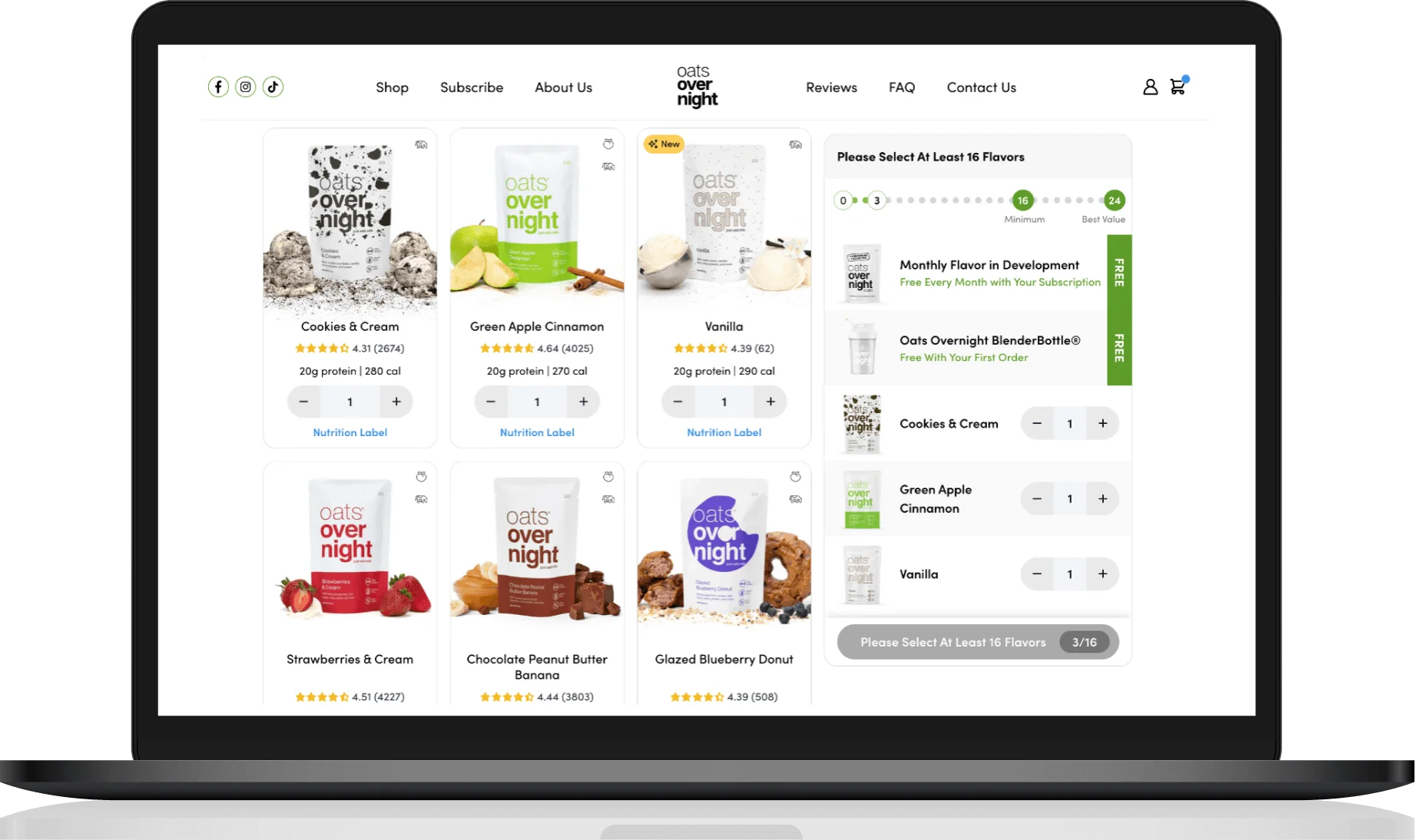

Oats Overnight offers 25 flavors—enough to have a different one every day for almost a month before repeating. And by then, there's a new monthly flavor to try.

Customers are adjusting orders more freely

+3% from the year before

Some trends are universal...

Top actions in every industry...

...some are not

19% of Health & Wellness customers skipped at least one order...

...but just 8% of Home & Pet subscribers did.

Your body may wait for nutrients, but the cat won't wait for treats.

Adapt & educate

Onboarding is your best opportunity to help customers understand your products and avert misunderstandings.

A new customer may have no idea how many pounds of coffee beans they need each month. But they probably know how much coffee they drink, so ask them about that and you can guide them to the right quantity.

Different problems, different solutions

Sometimes it's easier to calibrate quantity than expectations. Products like supplements can take time to produce results, and they risk losing customers in the meantime.

Consider pairing up-front product education with gentle encouragement to stick with it, like a loyalty track that issues rewards at key phases of the product lifecycle.

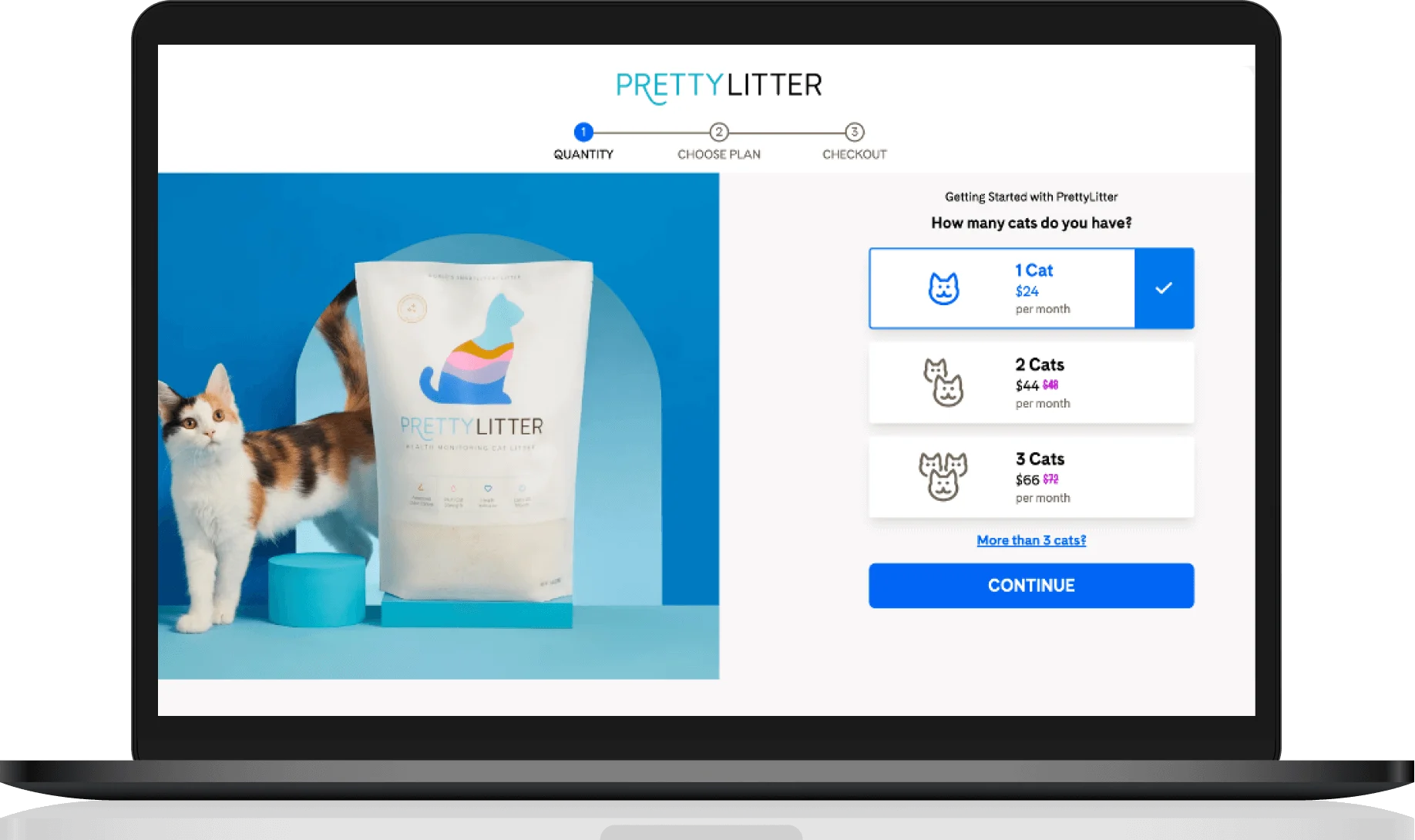

PrettyLitter avoids uncertainty by asking new customers how many cats they're providing for, not how much product they need.

The takeaway

Flexibility is mandatory

Easy subscription management is table stakes, not a differentiator. There are too many options for a subscriber to stick with one that won't accommodate them.

Don't complicate customers' days, complement them.

No brand's an island

When a subscription brand thrives, they aren't just succeeding for themselves. They're also winning customers over on the very idea of subscriptions and making the industry stronger as a whole. We think that's pretty cool.

It also means that none of us is in this alone. Take a look at who your best friends are.

A customer who subscribes to

has a 21% chance of subscribing to

Lapsed subscriber reactivation

If you don't track how many former subscribers come back to your brand, you're not alone. Why look to the past with all these present and future subscribers to worry about?

But we're paying attention. A typical brand saw about 15% of subscribers renew after cancelling, same as last year.

That consistency means there's an opportunity out there most brands aren't taking advantage of—customers who already know your brand and products, at a fraction of the cost of acquiring all-new customers.

The opportunity

Use what you know about former subscribers to lure them back. Offer compelling deals on products they used to love, or new launches that line up with their old shopping habits.

Almost 1 in 5 subscribers returned after cancelling

The rest are untapped potential—lots of potential subscribers, low acquisition costs

About this report

Insights in the Subscriber Trends report are based on data collected from the brands that use Recharge to power their subscriptions. The timeframe reflected is July 2023-June 2024, plus the same period a year earlier for comparison.

To enable comparisons between subscribers and non-subscribers, our dataset also includes order data from Shopify.

Data excludes brands classified as Fashion & Apparel, which are numerous enough to skew the Other category heavily.

All metrics exclude brands who launched or adopted Recharge during the given timeframe and thus did not produce a full year of data.

Except where stated, metrics reflect the median brand within the given industry to make them directly applicable to our brands.