Payment methods for your ecommerce subscription: How to choose the best ones

Published February 2024

Published Feb 2024

Updated February 2026

Updated Feb 2026

6 min read

AI Summary

Payment is a crucial part of an ecommerce business’s customer experience. But with so many options available, it can be difficult to know which options are the best for your business and for your subscribers.

Payment is a crucial part of an ecommerce business’s customer experience. But with so many options available, it can be difficult to know which options are the best for your business and for your subscribers.

This blog will cover the factors you should consider when choosing a payment method for your online business or subscription, plus some of the top options on the market.

Understanding available payment methods

There’s a broad array of options available to ecommerce businesses:

- Credit and debit cards

- Digital wallets

- Bank transfers

- Buy now, pay later

No one payment method will cover every business and every customer. As an online merchant, your best option is to accept multiple payment methods that combine to cover the bulk of your transactions.

Credit and debit cards

Since most customers likely already have either a credit or debit card, these are some of the most widely-used online payment methods. They’re almost universally accepted both online and in physical stores.

Cons of credit and debit cards

While credit and debit cards are widely accepted online, they can lack certain convenience and security features common to digital wallets, including one-step payment and two-factor authentication. Their use also requires your business to work with a payment gateway.

Digital wallets

Unlike traditional bank cards, digital wallets are third-party services that act as intermediaries between businesses and customers. They enable customers to save payment and personal details like their shipping and billing address for use across every website that supports their digital wallet, providing a smooth and easy checkout experience even for first-time customers. Their ease of use makes them one of the most popular payment methods on the market.

Digital wallets also take steps to protect users’ payment details and private information with features like two-factor authentication and data encryption, making them a trustworthy option for both businesses and customers.

Cons of digital wallets

Digital wallets have relatively few drawbacks compared to many other payment methods. However, some users may prefer not to share their information with a third party. Businesses also need to specifically support each wallet, meaning there’s no universally accepted option. Each wallet’s usefulness is limited to the stores that accept it.

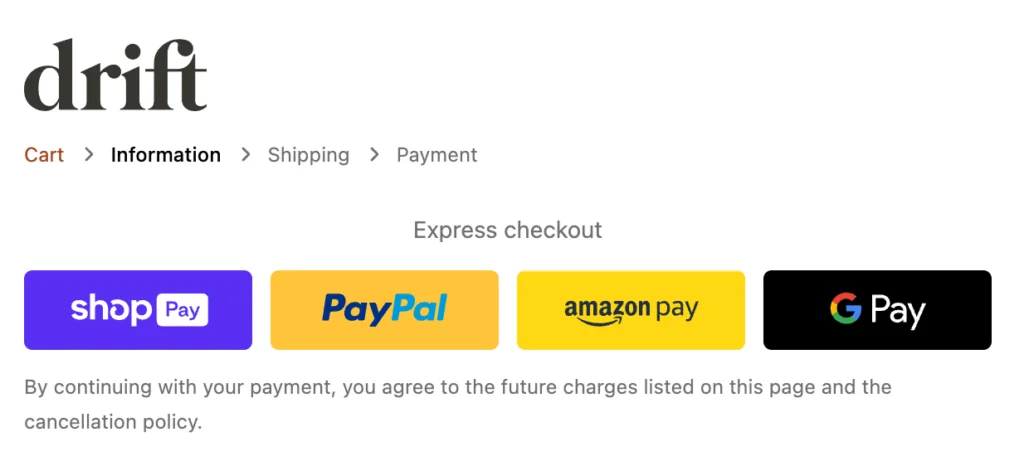

Examples of digital wallets include:

- Shop Pay

- PayPal

- Apple Pay

- Google Pay

Tip: Recharge supports payment from all four.

Bank transfers

Similar to debit transactions, bank transfers enable customers to transfer money directly from their bank accounts to merchants. These are more popular in Europe and Asia than in North American markets.

Cons of bank transfers

Though relatively safe and secure, bank transfers can vary more widely in speed and ease than other payment methods due to the more variable processes and institutions involved.

Buy now, pay later

Especially for large transactions, customers may prefer to defer or spread out payment. Buy now, pay later (BNPL) providers like Klarna and Affirm have become popular among both customers and businesses for enabling flexible payment schedules.

Cons of BNPL

There are few downsides associated with simply supporting BNPL. However, details like spending limits and payment plans vary between providers, so if BNPL makes sense for your business, be sure to choose an option whose terms suit your products’ price points and your customers’ preferences.

Factors to consider when choosing a payment method

Not all payment methods provide the same features and benefits. Be sure to select options that are:

- Popular among your customers

- Equipped with up-to-date security features

- Accepted in the markets you operate in

- Economical for your business

- Easily integrated with your chosen ecommerce platform

Customer preferences and demographics

Different payment methods are more common or more popular among different demographics. Before deciding which ones to support, it’s important to understand which ones your customers are likely to prefer. Take into account both the market you operate in and the specifics of your target market to determine which payment methods will result in full coverage.

Security and fraud protection

A customer may not explicitly consider security when selecting a payment method. But considering the risk that security breaches and fraud could pose to you and your customers, it’s paramount that you consider it.

Features like two-factor authentication and encryption are highly valuable for the layers of security they provide customers. Fraud detection is also essential for ensuring that customers’ payment methods and information aren’t used without their knowledge. All of these may be included with different payment methods and providers, so consider the options available to you when selecting them.

Geographic considerations and international transactions

International ecommerce can be complex. Before you expand to a new country or begin accepting international transactions, be prepared to navigate local processes and preferences for payment (or integrate with an ecommerce platform that handles them).

Case study: optimizing international transactions

Bird&Be tackled sticky currency conversion problems by implementing Recharge’s multicurrency feature.

Transaction fees and processing time

Processing fees and times can vary between payment methods. Credit card fees for merchants, for example, can vary from 1.5% to 3.5%, and bank transfers may involve extra steps that slow processing times. You’ll need to weigh fees and processing time for each method against factors like its popularity in your market and ease of implementation.

Integration with your ecommerce platform

It may seem obvious, but it’s important to consider how easily you can support different payment methods on your platform. Some platforms provide native support for a variety of options; others may provide more limited support, requiring you to invest more in supporting them yourself—or forego them altogether.

You’ll need to weigh the level of effort required to support each method against its usefulness to your customers.

Best practices for implementing payment methods

Ensuring PCI compliance and data security

Businesses that expect to handle customers’ card data should comply with the Payment Card Industry Data Security Standards (PCI DSS), a set of internationally-observed standards set by the Payment Card Industry Security Standards Council.

There are many factors involved in PCI compliance. Relying on established, creditable providers who are already PCI-compliant is one way to streamline your own business’s compliance.

Offering incentives for using certain payment methods

If a payment method is exceptionally convenient or economical for your business, it may be worth devising ways to make it appealing to customers. Consider offering perks like product samples or points in your loyalty program to customers who use that payment method.

Note that incentivizing one payment method doesn’t necessarily mean disincentivizing another. Some localities have regulations against practices like charging fees for credit card transactions. Be sure that your practices comply with local regulations.

Cover all your bases with these payment options

Checkout and payment have an outsized impact on your business’s customer experience. Get to know your customers and their payment preferences so you can meet their needs and support their payments. Choose your lineup of payment methods carefully, considering factors like their security, prevalence, and financial impact to your business.

Remember, success in ecommerce isn’t just about details like payment options—it’s about crafting a smooth, customer-centric experience at every touchpoint.

Categories