The tides are shifting, and what was once an attention-based economy has now transformed into the routine economy. Consumers are putting their dollars toward building up their routine, and brands can leverage this to position their products as essential parts of customers’ daily lives.

This era of product consumption bodes well for subscription-based businesses: After all, maintaining a steady stream of recurring revenue is the cornerstone for sustained growth. However, one of the significant hurdles that businesses still face is failed payments, which can lead to involuntary churn—a scenario where customers unintentionally lose access to a service they still value.

Addressing failed payments promptly and efficiently can significantly improve retention rates and customer satisfaction. This article explores strategies to enhance retention through failed payment recovery, ensuring that businesses can minimize disruptions and keep their subscribers engaged.

Key takeaways

- Failed payments, due to reasons like expired cards or technical issues, are a significant hurdle for subscription-based businesses, potentially leading to involuntary churn despite customer interest.

- Businesses can improve retention by addressing failed payments with strategies such as proactive communication, automated retry processes, simplified payment updates, personalized customer support, and incentives for quick resolution.

Understanding the causes of failed payments

Before diving into strategies for recovery, it’s essential to understand the common causes of failed payments. These include:

- Expired credit cards: One of the most frequent reasons for payment failures is an expired credit card. Customers often forget to update their card details, leading to unsuccessful payment attempts.

- Insufficient funds: Customers may not have sufficient funds in their account at the time of the transaction. This can be due to budgeting oversights or unexpected expenses.

- Technical issues: Sometimes, technical glitches within the payment gateway or processing systems can cause payments to fail.

- Bank issues: Occasionally, banks may block transactions they consider suspicious, leading to failed payments.

By identifying the root causes, businesses can tailor their recovery strategies to address specific issues more effectively.

4 strategies for improving retention through failed payment recovery

Implementing a strong retention strategy and improving it by as little as 5% can increase gross merchandise value (GMV) by 25%, so it makes sense that brands are looking for the best solutions to combat churn. You can address this hurdle with automated technology built on these principles:

- Proactive communication

- A stellar customer experience

- Automation

1. Proactive communication and reminders

Effective communication is key to recovering failed payments. Implementing a system of proactive reminders can help prevent payment failures before they occur. Here are some tactics:

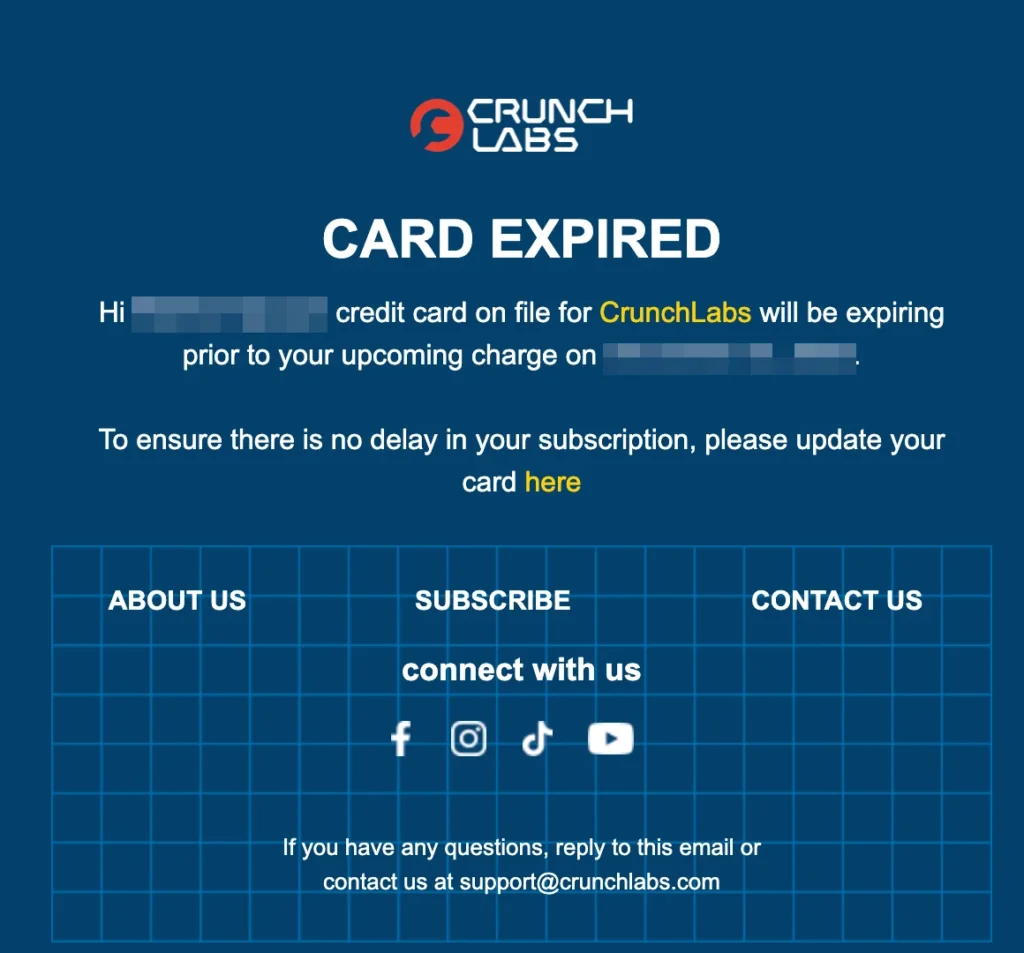

- Preemptive notifications: Send notifications to customers before their payment method is set to expire. Reminders can be sent via email, SMS, or in-app notifications, prompting customers to update their payment information in advance.

- Grace periods: Offer a grace period for customers to update their payment details after a failed attempt. During this period, continue providing the service to avoid immediate disruption, making it easier for customers to rectify the issue without losing access.

2. Automated retrying of payments

Automating the retry process can significantly increase the chances of successful payment recovery. With tools like Failed Payment Recovery (FPR), this process becomes seamless. Here’s how:

- Smart retry solution: Implement a smart retry solution so that it’s one less thing off your plate. Automating to create a frictionless retry and card update experience can reduce barriers to updating payment information and scale your subscription program effortlessly.

- Data-driven strategy: Use data analytics to determine the optimal times for retrying payments based on customer behavior patterns. With Recharge’s tool, you can track your overall revenue saved, analyze daily recovery patterns, and identify the recovery method used.

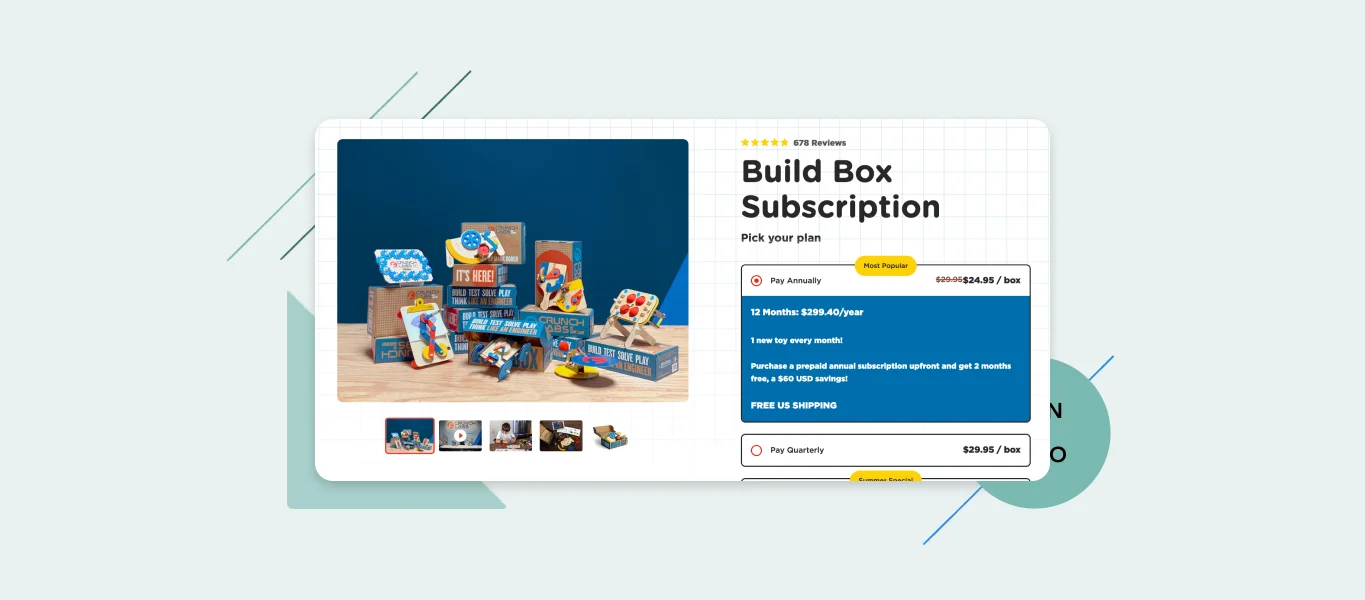

3. Simplified payment update process

A seamless and straightforward process for updating payment information can reduce friction for customers. Consider these approaches:

- User-friendly interfaces: Design an intuitive interface that makes it easy for customers to update their payment details. Reduce the number of steps required and provide clear instructions to guide them through the process.

- Multiple payment options: Allow customers to choose from a variety of payment methods, including credit cards, debit cards, digital wallets, and bank transfers. Providing multiple options ensures that customers can select the method that works best for them, reducing the likelihood of failed payments.

4. Personalized customer support

Providing personalized support can make a significant difference in recovering failed payments. Here’s how to enhance customer support:

- Dedicated support channels: Offer a dedicated team that is focused on lifting recovery rate, that are enabled to optimize your setup.

- Personalized assistance: When reaching out to customers about failed payments, personalize the communication. Address customers by their names, reference their specific situation, and offer tailored solutions. This personalized approach can make customers feel valued and more willing to take immediate action.

Get ahead of payment-related customer churn

Failed payments are an inevitable challenge for businesses focused on the routine economy, but with the right strategies, they don’t have to lead to customer churn. Luckily, technology like our Retain product suite is surfacing to make improving retention with failed payment recovery an easy and seamless process.

By implementing proactive communication, automated retry systems, simplified payment processes, personalized customer support, and offering incentives for quick resolution, businesses can significantly improve retention rates. These strategies not only help recover lost revenue but also enhance the overall customer experience, fostering long-term loyalty and satisfaction.