How reducing customer churn impacts LTV and CAC

Published February 2019

Published Feb 2019

Updated February 2019

Updated Feb 2019

22 min read

AI Summary

Recently, there’s been a lot of talk about LTV and CAC, but there’s one more metric that can drive subscription companies truly mad: churn — and it warrants its own explanation and strategy. Churn occurs when a customer cancels their subscription.

Recently, there’s been a lot of talk about LTV and CAC, but there’s one more metric that can drive subscription companies truly mad: churn — and it warrants its own explanation and strategy.

Churn occurs when a customer cancels their subscription. While this may seem simple, churn is a beast that can wreak havoc on your entire business.

Look at it this way: If you’re acquiring 10 new customers a month, but also have 10 customers a month cancel, your business is essentially at a stand still. You’re running on a treadmill, not a track.

Conversely, if you’re acquiring 10 new customers a month, but churning out 15 customers a month, you’re running a failing business. Even if you have a constant stream of new leads and customers, if your churn gets out of hand, you could be running backwards.

So what we’re really trying to say here is: Churn is arguably the most important measurement for subscription box companies.

If your churn is out of control, LTV and CAC fade into the background. Your business will start to suffocate if you don’t turn your focus to the other side of the equation.

So let’s dive in. We’re going to talk through the basics of churn, the insane impacts it can have on your LTV and CAC, and actionable steps to start beating your churn before it beats you.

Be sure to opt into the new Recharge content stream written by industry experts like Kristen.

What is churn and where does it come from?

Before we go any further, let’s settle on our definition of churn.

According to Hubspot, “Customer churn is the percentage of customers that stopped using your company’s product or service during a certain time frame.”

In simple terms: Churn occurs when active customers or subscribers of any kind end their relationship with a business.

Now that we’ve got a handle on what we’re really looking at, diagnosing the reason why customers are leaving is the first plan of action.

And no matter how big or small your company is, customers either leave voluntarily or passively. Let’s break it down.

Voluntary Churn:

This is probably the kind of churn that comes to mind first. Voluntary churn occurs when a customer actively chooses to cancel their subscription. There are infinite reasons a customer will come to this conclusion, so we won’t get too bogged down in cancellation reasons.

But don’t fret.

When we boil it down even further, customers really only choose to leave for one of two reasons: Either something happened to them (they moved, shaved their beard, or redid their finances) or they weren’t getting enough value from your product.

Roy Olende, a product researcher at social media managing company Buffer, explains how these reasons apply in the context of their customers:

“Customers churn because either other aspects of their work take up a greater significance, or folks are searching for a specific feature and if we don’t have it, it’s easy to switch to another product.”

Involuntary Churn:

Now this one is where it gets interesting.

Involuntary churn occurs when a customer passively cancels their subscription. If that sounds a bit wonky, hang tight. Involuntary churn (also known as passive or delinquent churn) is the result of billing issues that results in a cancelled subscription.

Unlike single purchases where payment information is taken and billed right away, subscription-box businesses rely on recurring charges. The payment information is retrieved at the initial sign-up, then charged on a recurring basis over the lifetime of the subscription.

With a set up like this, billing issues are not only possible, but inevitable. From expired cards to fraud alerts and spending limits, there are many reasons why an automatic payment might fail.

When a billing issue occurs, the monthly invoice goes unpaid and you need to find a solution before the customer slips away completely.

How preventing churn impacts LTV and CAC

The benefits of preventing churn are pretty obvious: keep more customers, unlock more growth, continue to scale your business. Awesome.

But it goes even further than this. Reducing your churn can have staggering impacts all across the board; from employee retention to customer loyalty, all the way down to LTV and CAC.

Churn seeps into so many corners of your business, yet so many subscription box companies fail to give it the attention it deserves. So, let’s look a little deeper into how it impacts two of your most important metrics: LTV and CAC.

Churn’s Impact on LTV

This one is pretty straightforward. LTV is the total value of one customer over the entire length of their subscription. Total customer LTV is the average Lifetime Value of all of your active customers combined.

This metric essentially says: From 2015 when Josh signed up for Cool Subscription Box, to 2018 when Josh cancelled, we made $50 per month for a total of $1,800 from him. Thanks, Josh!

So, Josh churned in 2018. What if you had churn prevention measures in place that kept her around for another year? Now, Josh’s LTV bumps up to $1,800 +1 year of payments for a new total of $2,400.

It’s obvious to see that churn and LTV go hand in hand.

As churn goes down, subscription lengths extend, and LTV increases. As churn goes up, subscription lengths shorten, and LTV decreases.

So, if LTV is on your radar, churn should be right there next to it.

Churn’s Impact on CAC

This one is a little more complex, but just as important. CAC is the cost it takes your business to acquire a new, paying customer. Pretty simple: the lower your CAC, the better.

So how can churn (the end of the road) impact CAC (the very beginning of the road)?

We’ve established this simple rule: When you reduce churn, you extend the LTV of your customers. Great. Now, how does churn impact a LTV to CAC ratio??

Essentially, it’s a cycle that’s constantly compounding on itself.

When you extend the LTV of your customers, your overall revenue goes up. So as you focus on reducing churn and increasing LTV, you simultaneously start to unlock more cash flow for your business.

So now you have a lower churn rate, a higher LTV rate, and extra cash in the bank.

As you continually unlock more time, resources, and money, you can pivot those assets towards your marketing efforts. With more hands on deck and more resources to apply to growth, you can focus on optimizing your systems to bring in more leads and convert those leads at a higher rate.

Reduce churn, increase your LTV, unlock resources for growth optimization, reduce your CAC. Churn is the first domino to fall.

Tackle the simple churn first

Before we dive into strategies, It’s absolutely vital to understand why people are churning and how that impacts the rest of your business. Without a sound foundation built, battling churn can become a chaotic mess. So everything we discussed first was just as important as these strategies.

Battling churn can seem really overwhelming. With so many customers leaving for an infinite number of reasons, subscription box companies can quickly become stressed and choose to retreat from the fight. Please don’t. We know how valuable reducing churn can be, there’s no reason to hide.

So, where do you start? Involuntary churn.

With any war, you want to pick off the easiest battles first. And your war against churn is no different. Involuntary churn is the easiest leak to plug since customers aren’t necessarily choosing to leave.

Now, you might be wondering if failed payments can really account for that much churn. It may not seem like a big issue, but Churn Buster has seen subscription companies with up to 50% of their total churn being attributed to failed payments.

And these numbers climb even higher for B2C business models that can be more volatile or susceptible to credit card issues, like subscription boxes.

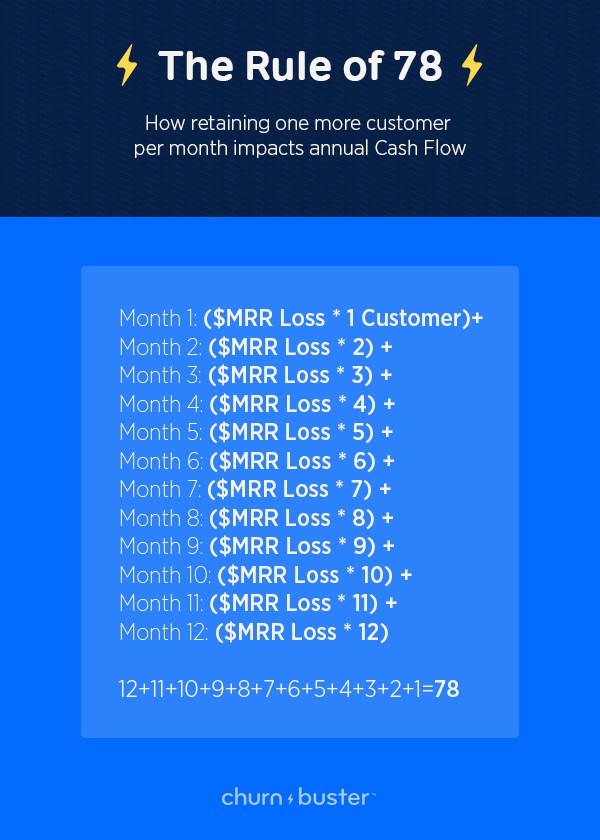

Plugging this leak first is the most efficient way to start slashing overall churn. Even recovering one more customer per month has remarkable impacts on your business. And oftentimes, the compounding impacts of churn are overlooked.

Let’s look at the math. The Rule of 78 shows how plugging up a recurring loss can lead to monumental impacts on cash flow. To calculate this out, take the recurring loss you’ve plugged, multiply it by 78, and that’s the amount of new cash you’ll have a year from now.

So every leak truly is worth plugging.

Now, here’s the good news.

Typically, 70% or more of these billing issues can be resolved and Lifetime Values restored, if you know how to fight right.

This is where dunning comes in. And like most other things, dunning can be done well and improve your recovery with staggering results, or it can be done the easy way, leaving the bucket still a bit leaky.

Dunning & how to do it right

Dunning, or the communications you send out to remind users to update their payment information, is the only way to beat involuntary churn. To start, you’ll want to take a look at your dunning set up and see what you’re currently doing.

Likely, you will have an internal system of manually reaching out to customers and/or have employed a basic dunning tool. Usually, these setups are simple check-box additions that often fall short in performance.

With either of these solutions, you’re letting a lot of customers slip through the cracks, and burdening your company with manual outreach and compounding negative impacts.

So, what does your dunning system need to look like to be truly leak-proof? Let’s walk through some proven tactics for improving revenue recovery.

- No Pre-dunning:

Pre-dunning, or sending warning emails to customers before their payment fails, has been rendered obsolete by automatic card update technology.

We won’t go into depth here, just don’t do it. Turn off any pre-dunning emails you have running.

- Custom retry schedules:

Basic dunning setups tie emails to every card retry. This means that every time your system attempts to retry the payment, your customer also gets an email asking them to update their information.

On the surface, this may seem like a good practice, but for optimal recovery it can actually be pretty damaging.

When you decouple retries from emails, you really start to unlock the magic of pro dunning. On average, 21% of failed payments can be solved simply by retrying the same card multiple times, so why bother your customers if you don’t have to?

With custom retry schedules, you actually have the chance to independently test different retry schedules and email sequences to improve recovery. It’s applying basic marketing optimization to your dunning process.

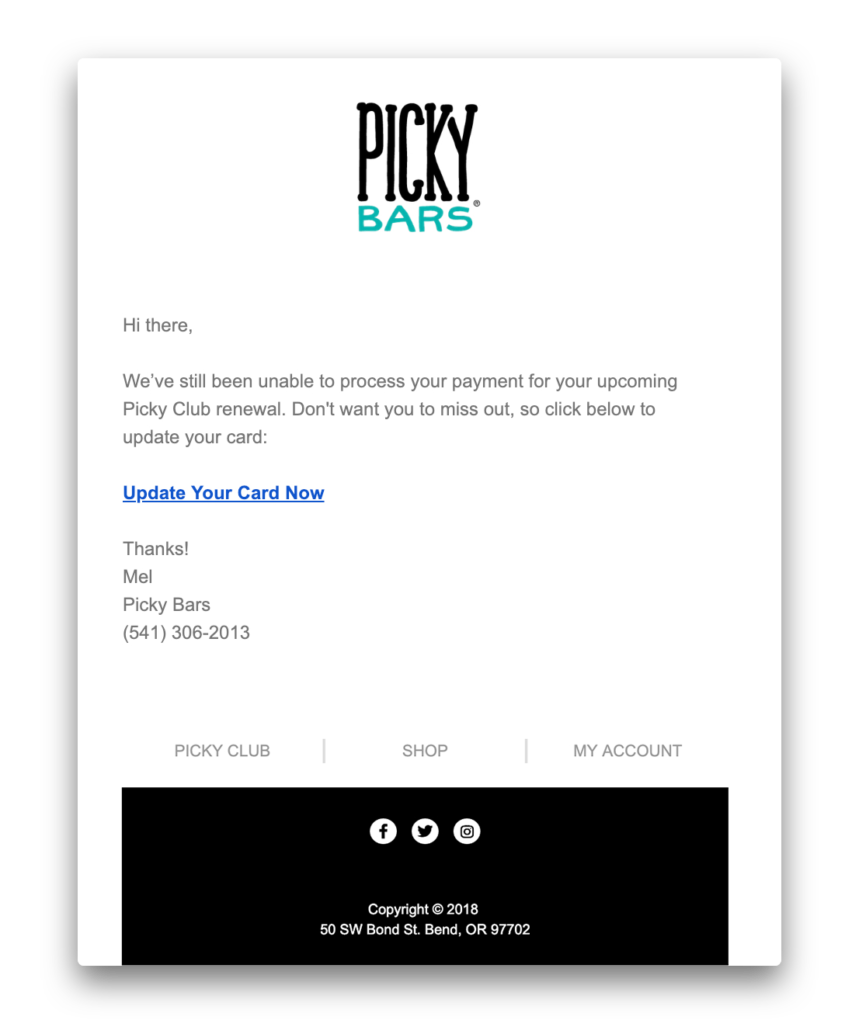

- Branded Emails:

Most dunning providers only provide one simple template for your dunning emails. Which may seem just fine, it’s just a simple transactional message anyways, right?

What companies (and dunning providers) often overlook is the impact small tweaks can make on the overall customer experience.

Ensuring your dunning emails are branded and recognizable make it easier for your customers to trust them. In turn, making it more likely they’ll hit the coveted “Update your card info” button.

Here’s a great example from Picky Bars. They’ve included subtle branding such as a clean logo and an HTML footer. It gets right to the point, but maintains the brand identity alongside the important message.

- Reliable delivery:

Everyone harps on the importance of deliverability when it comes to marketing emails. So why isn’t the same focus put on transactional emails?

Transactional emails, such as password resets, automatic receipts and dunning emails carry a heavy weight for your business. Real money is on the table, so why risk poor deliverability?

Here are some quick tips:

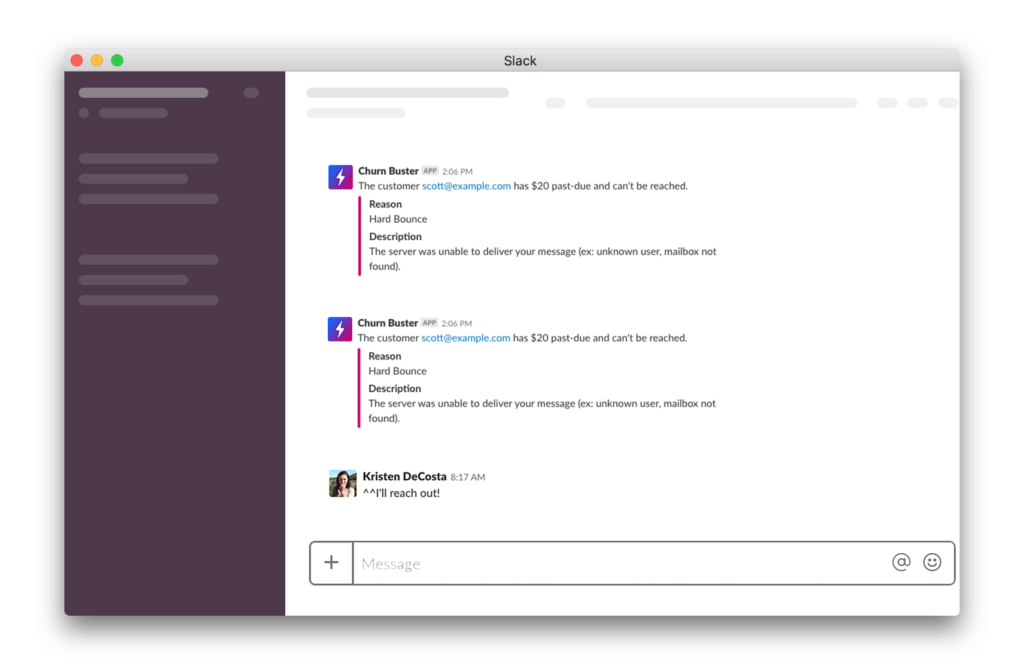

-Use an email delivery tool that works: Churn Buster uses and loves Postmark for all dunning emails sent out. Currently, Recharge does not directly integrate with Postmark, but Zapier is a great alternative to get most of the functionality out of the pair.

–Set up the correct records to build trust and improve deliverability.

–Trigger alerts for bounced emails so you can take the necessary steps to get in the inbox. Slack alerts are a great option for this.

–Make email updating easy for your customers. If their email changes, or if a new email takes over the account, make it simple for your customer to update the information. Out of date billing contacts are the most predictable source of churn.

- Seamless card updating:

When you have to ask a customer to update their credit card information, make it as easy and seamless as possible.

Customize your card-update pages to match your branding, bypass the login so customers don’t have to fish out a password, make the page mobile responsive (over 70% of card updates happen on mobile devices), verify payments on the spot, and triple check those pages are secure and safe.

- Subscription reactivations:

When a customer does update their card information, your system has to be set up to ensure the subscription gets reactivated and the payment goes through.

Without proper reactivations, ghost customers will start to hide out in your system.

Ghost customers occur when the card is updated outside of the retry window, and your payment processor fails to reactivate the subscription.

Both you and your customer may think they’re still subscribed, but future payments won’t actually go through.

Preventing ghost customers is a simple fix, but most basic dunning solutions overlook it.

- In-depth analytics:

This is where basic dunning solutions really fall short. They often provide very little data into your recovery campaigns, stifling any optimization possibilities.

Be sure your system comes with full visibility into what’s working (and what’s not) and recovery breakdowns help guide optimization so you get better and better results over time.

How does your current system stack up to these requirements? Is it time to upgrade?

Luckily for Recharge customers, working with a professional dunning platform that covers all of these bases (and more) has never been easier. Recharge and Churn Buster have partnered up to ensure your subscription box company has the best dunning set up possible to keep your churn in control, without burdening you or your team.

There’s zero reason you should lose a customer involuntarily. Take advantage the of pro solutions available. It’s one of the few tools that will consistently make your business money every month.

So, we’ve tackled the first leak. There’s a simple solution. Let’s drill into the slightly more exciting side of it all: voluntary churn.

Tackling Voluntary Churn: Flipping the Script

Before we dive into tactical strategies for reducing voluntary churn, I want to pause and explore the higher-level strategy at play.

For many of you, this may be an entirely new way to look at your churn. So often, companies view churn as an incredibly negative monster trying to wreck their business. And while that’s not necessarily wrong, churn also has a nicer side… if you’re willing to look for it.

Instead of chasing around customers trying to make final saves, we’re going to start looking at it as a constant opportunity to develop deeper relationships with customers, to build a community around your subscription box, and to create an experience that your customers will rave about.

Matt Goldman, CEO Churn Buster

”

And it all boils down to the customer experience. This new angle on churn shows us this: The only way to truly minimize your churn is by going above and beyond for your customers at every single moment possible.

Simply put, it’s a lot easier to keep a customer around if 9/10 of their experiences with your brand and product have been positive. Alternatively, it’s much harder to keep customers around when only 6/10 of their experiences are positive.

The math is simple. Don’t gamble when it comes to retention.

Let’s walk through 7 vital steps for reducing voluntary churn.

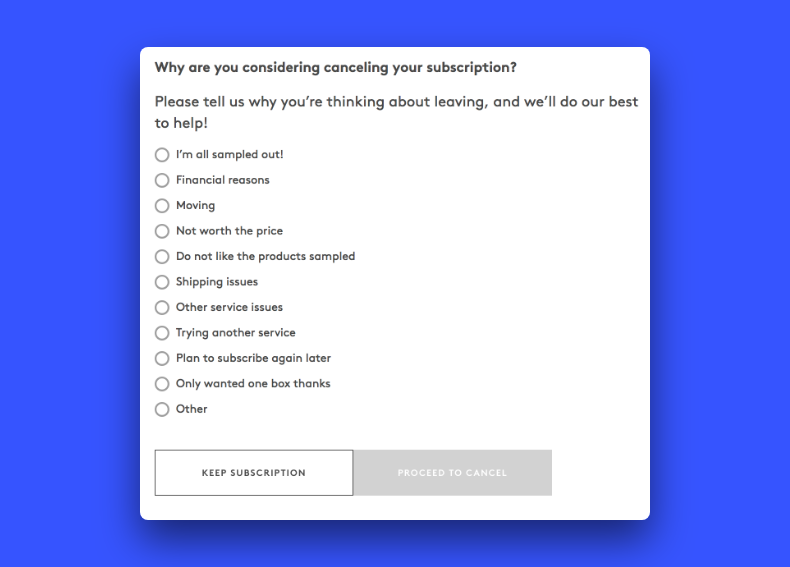

1. Get to know your churn

Before you can really dive into any churn improvement on the voluntary side, you have to understand where you churn stands right now. Essentially, you need a baseline to measure against once you start implementing tactical strategies.

If you aren’t already, make sure you are sending exit surveys out to any customers who cancel their subscription— but don’t try to make a sale here. These can be automated in your system, and are absolutely worth the investment.

An example exit survey from Birchbox.

Customer feedback is your ticket to improving overall retention, and the most important feedback will come from users who have chosen to cancel their subscription.

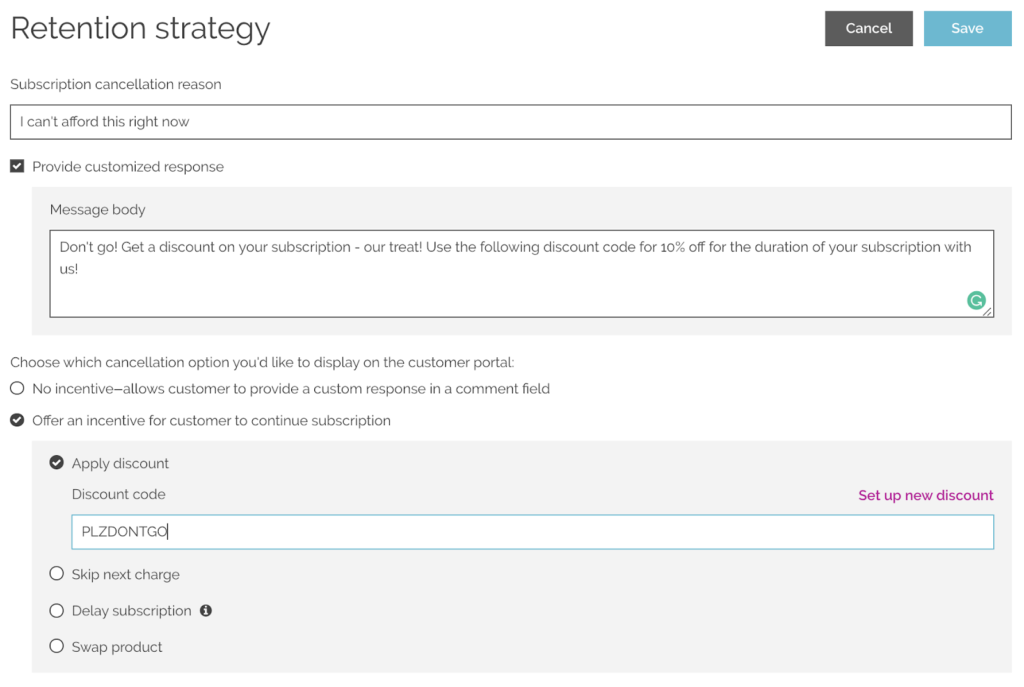

Recharge’s Retention Strategies feature is an awesome asset for your business. First, you can set incentive rules to try and retain a customer who is considering cancelling. Which is a killer retention technique we highly recommend using.

Additionally, when your customer does choose to cancel, Retention Strategies automates feedback surveys, so you can rest easy knowing you’ll be pulling this data for further investigation.

Eventually, you will start to pinpoint trends in the responses, showing you where the subscription is falling short, why people are choosing to leave, and where the value is dropping off for these users.

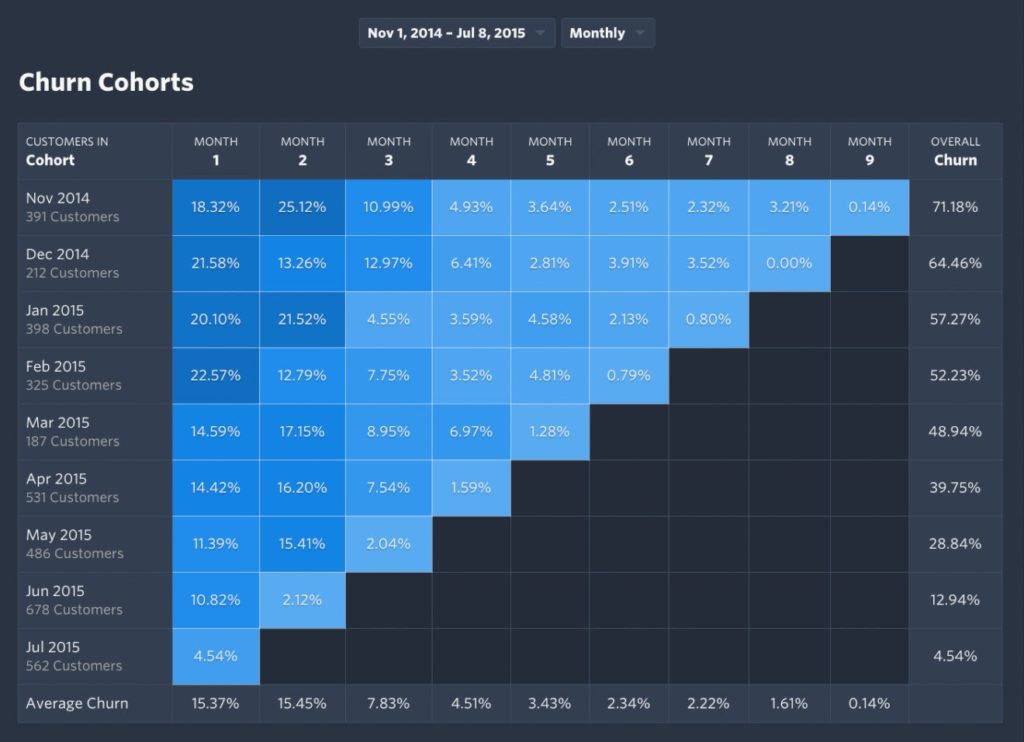

Next up, I highly encourage you to start visualizing this data with a cohort table. It will give you a high-level view of the typical customer journey.

When in the customer lifetime is the highest level of churn? How long is the average subscription length?

These time-based data points can shed a ton of light on where you need to hone in on your churn prevention.

Getting a deep understanding of your churn will take time. It’s a long-term commitment to gathering data, analyzing, and creating strategies, but it’s worth the investment.

2. Get to know your most loyal customers

Not only is it important to understand your most unhappy customers (the ones who have churned), it’s just as necessary to really understand the happiest ones.

Your most successful customers are the ones who have stayed with you through thick and thin, who have written raving reviews or testimonials, who have become an affiliate or have referred someone to your subscription box.

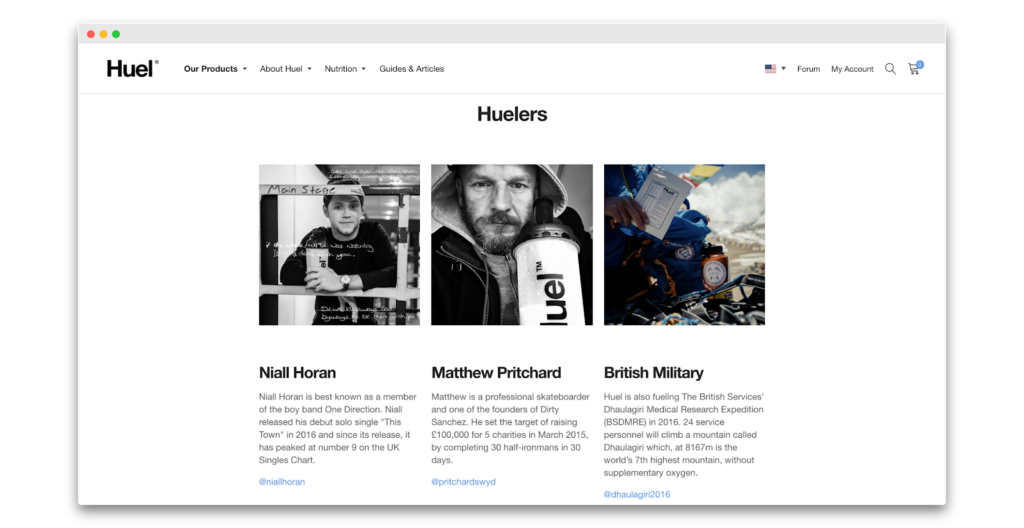

These are the people you want to reach out to. Hop on a call, send out surveys, interview them for your blog, feature them on your website, whatever it takes to start building a deeper understanding of these people.

Huel does a great job of this:

Get to know these customers’ needs and wants, why they chose your subscription box, what they love about your brand, where they feel you may be falling short, and how you could improve over the long-haul.

So long as you are serving your most successful customers first, you’ll create more and more of them. Now that you know what’s made them so happy, you can replicate that journey, and even improve on it to foster more VIPs.

3. Map it out

Most of your customers take a similar journey with your product. There will be a path based on your engagement schedule. So, put yourself in your customer’ shoes and see the subscription as they would.

Go through the process on your own and get a feel for the journey. Map out when, where, and how your brand engages with customers. Submit a support complaint and see how the follow-up is.

This is a step most companies overlook. They assume they have great engagement set up throughout the journey or already invest 110% in their customers. But then they go to map it out and are shocked to find big gaps in communication.

Figure out what it’s truly like to be a customer to your subscription box.

4. Highlight at-risk moments

Now that you’ve mapped it all out, you want to highlight any at-risk moments that are happening within your customer journey. Every company will have them, no one is immune to these moments.

What you want to look for first is big gaps in the customer experience. Lengths of time where customers go without any contact from your brand. Make sure you take note of these long radio silences, they’re extremely important.

Next, you want to look for natural pauses and small points of decision in the customer journey. While these customers have made the primary decision to sign up for a subscription, they are still making secondary and tertiary decisions along the way.

I got my first delivery, do I want to continue to receive them? The price of my favorite box increased, is it still worth the price? After my customer support complaint, are they willing to help me through this? Is the value truly here? Do I feel part of a community and/or a valued member to the business?

The ultimate goal is to make these micro-decisions automatic for users. It’s not deception, it’s loyalty. If they absolutely love your product and the experiences that come with it, these decisions will become much less risky.

5. Engage and support

All of these at-risk moments are places where you can either go above and beyond for your customers or fall short. And each time you fall short, it’s a strike against the experience.

Now that you’ve highlighted the most at-risk periods in your customer’s experience, it’s time to create strategies to counteract churn. And it all boils down to engagement.

Employ genuine, proactive engagement with your customers where it truly provides value for them. Continue to build deeper relationships and invest in supporting them, building a community for them, and making every moment on their subscription fun.

Here are some stellar examples of customer engagement:

Your social channels are an effective tool for customer engagement as well. Hubble does a fantastic job of engaging with their customers through social media.

Their Instagram feed is full of reposted pictures and videos from customers. This encourages other customers to join in on the community and share their own experiences. It’s a great engagement tactic that I encourage all subscription boxes to employ.

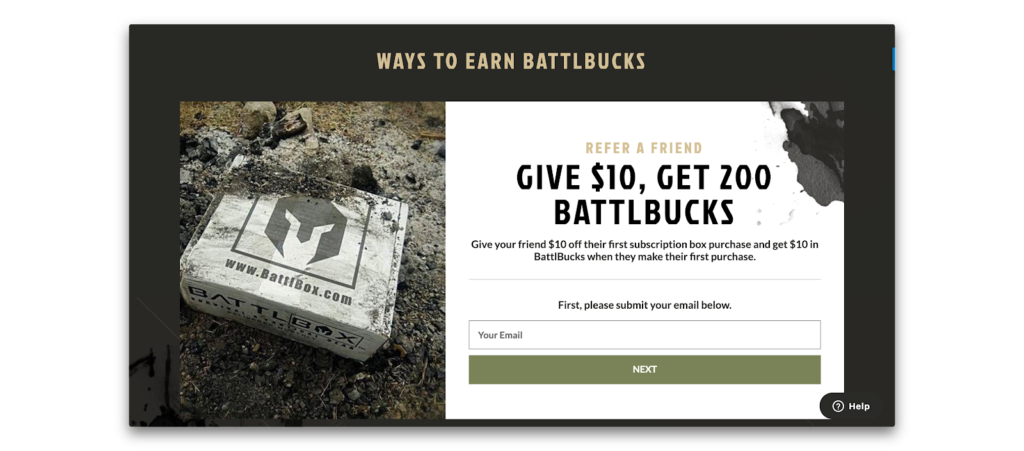

You can create a tribe-like atmosphere around your subscription box by offering current members a “refer-a-friend” deal. Battlebox includes this incentive in their Battlebucks rewards program. This is an efficient way to not only celebrate and engage with your customers, but to reward them as well.

6. Measure and track improvement

Mapped it out, check. Pinpointed risk factors, done. Crafted strategies for each, bingo. Now this step is easy.

For all of the strategies you have put in place, you want to make sure you are tracking and measuring the success or failures of each. Remember the baseline measurements we got when first understanding our churn?

Make sure you are collecting data on all of your engagement and retention efforts, then comparing month-over-month churn back to your baseline.

7. Rinse and repeat

And finally, like any good campaign, it’s never a one and done task. Constantly check in on the data and results, create an internal team focused on retention efforts when possible, and tweak the campaign to find better, more effective strategies of connecting with your customers.

Respect your churn, reap the benefits:

Focusing on LTV and CAC is absolutely vital for your subscription box company. But failing to look at churn right there with them is a costly mistake. The math is staggering, even a 1% increase in retention can have massive compounding impacts for your business.

Start looking at churn in a new light. Learn to respect the churn instead of running from it. Close the easy leaks first, ensure you have a solid dunning system in place, experience your product as a customer, then start investing as deeply as you can into customer relationships.

The positive benefits will trickle through every aspect of your business. And likely, make it all a bit more fun for you, too.

Hopefully, this has given you a more strategically sound way to approach your churn know that you can see h the huge impact it can make on your business every single month.

Churn Buster, in partnership with Recharge, tackles the scary parts of involuntary churn. We’re obsessed with it, and we’ve built a proprietary system to take the second guessing out of battling churn. Churn Buster adds a sophisticated layer of protection to surface failed payments, capture at-risk customers, and ultimately boost MRR. Read more about how Churn Buster and Recharge work together to reduce up to 20% of credit card failure.

It’s rare that we see an app integration that delivers compounding gains for our customers, and guarantees positive ROI. The fact that Churn Buster can be enabled in your Recharge account with just a few clicks is icing on the cake. I’m thrilled to be able to offer Churn Buster on the Recharge platform!”

Kevin Lew, Recharge Payments Integrations & Technology Partnerships

Check out Churn Buster on the Recharge Apps page and start fighting churn today!

If you enjoyed this article and want to read more content written by industry experts, be sure to opt into the new Recharge content stream.

Author Bio:

Kristen DeCosta – Growth Lead, Churn Buster

Kristen is dedicated to educating companies and founders on the importance of customer retention and the dangers of ignoring churn. When she’s not busting churn and crafting content, you can find her hiking a mountain or playing with her three rescue pups, Cooper, Tobi, and Finn.

Categories