Failed payments: What they are and how to solve them

Published June 2024

Published Jun 2024

Updated January 2026

Updated Jan 2026

4 min read

AI Summary

Failed payments are a major headache for ecommerce brands, distracting from core business activities and causing revenue loss. Since acquiring new customers costs five times more than retaining existing ones, understanding what failed payments are and how to address them is crucial for any subscription business. What are failed payments and why do they matter?

Failed payments are a major headache for ecommerce brands, distracting from core business activities and causing revenue loss. Since acquiring new customers costs five times more than retaining existing ones, understanding what failed payments are and how to address them is crucial for any subscription business.

What are failed payments and why do they matter?

Failed payments are transactions that are not successfully processed for a variety of reasons, such as insufficient funds, expired credit cards, or technical issues with payment gateways.

These failed payments are critical to address because they can interrupt financial operations and frustrate customers. Your business should monitor payment failures to maximize your revenue potential and stay ahead of competitors.

Subscriptions magnify payment failure issues

On average, 7% of all recurring charges fail on the first attempt, and their effect is even more pronounced on subscription orders. When a subscription payment fails, you don’t just lose the revenue from that payment—you lose the revenue from all of the subsequent subscription orders that would have been placed if that payment had been processed successfully.

This loss of subscription revenue due to failed payments is effectively a form of subscription cancellation known as passive churn. Failed payments demand immediate attention and effective resolution to prevent them from becoming a significant drain on subscription revenue.

The drivers of failed payments

Most failed payments come from a few common sources.

Incorrect information

Errors like inaccurate card numbers, expiration dates, or billing addresses can cause issues during payment.

Card errors

Insufficient funds or exceeded credit limits can result in a financial institution declining payment for a subscription.

Customer forgetfulness

Some customers simply forget to provide updated payment method information when it’s available.

The problem with manual solutions

Manual solutions make addressing involuntary churn ineffective and time consuming. Many brands manually contact customers about payment failure and have payment systems that simply retry payment over and over, both of which require extra resources and produce less effective results.

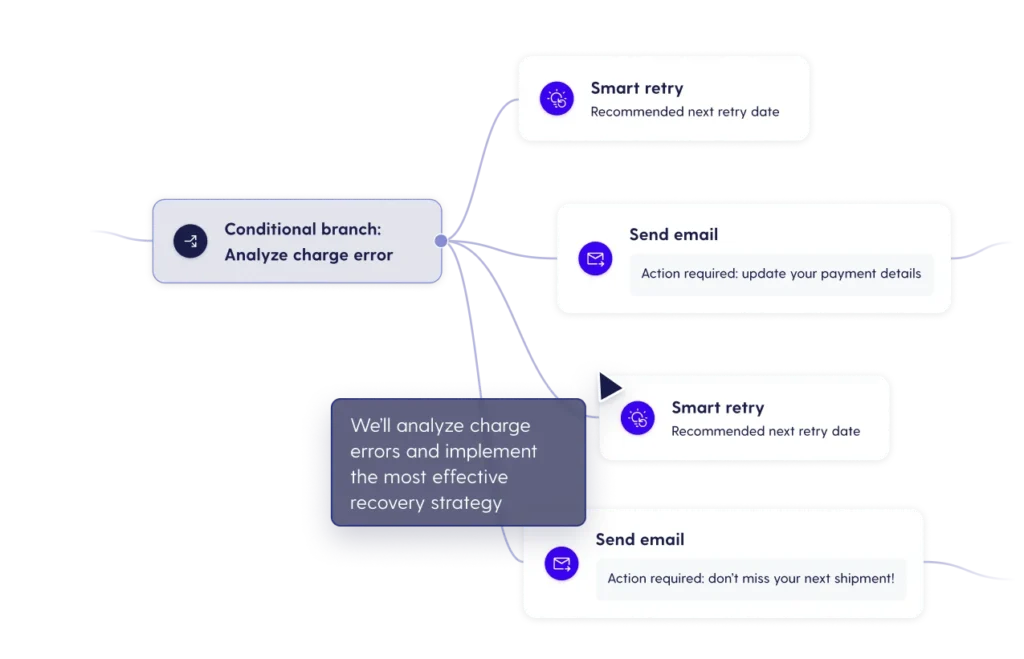

Top brands are now pivoting to automated tools that have smart payment processing, timely communication, and analytics to discover when and how charge errors happen.

How top merchants solve failed payments

To minimize customer outreach, maximize your hit rate, and retain customers, use a smart solution that leverages machine learning and artificial intelligence to determine the best time to recover failed payments.

Recharge’s Failed Payment Recovery leverages a custom machine learning model trained on Recharge’s 20,000 merchants and 1.3 million daily transactions to find the optimal time to recover a payment. Our model looks at data including (but not limited to) the type of error, time elapsed since the first retry, and the time of the month or week that retries are most likely to be most effective on.

Effective results

Merchants who have switched to Failed Payment Recovery from our standard dunning solution are already seeing up to a 23% increase in their recovery rate. That means more customer lifetime value (LTV) and monthly recurring revenue (MRR) retained for those businesses.

Frictionless experience

Thanks to Recharge’s partnership with Shopify, Failed Payment Recovery enables customers to update payment information directly in the customer portal.

This exclusive feature, available only for Shopify Checkout users, eliminates friction from the process, getting payments back on track seamlessly.

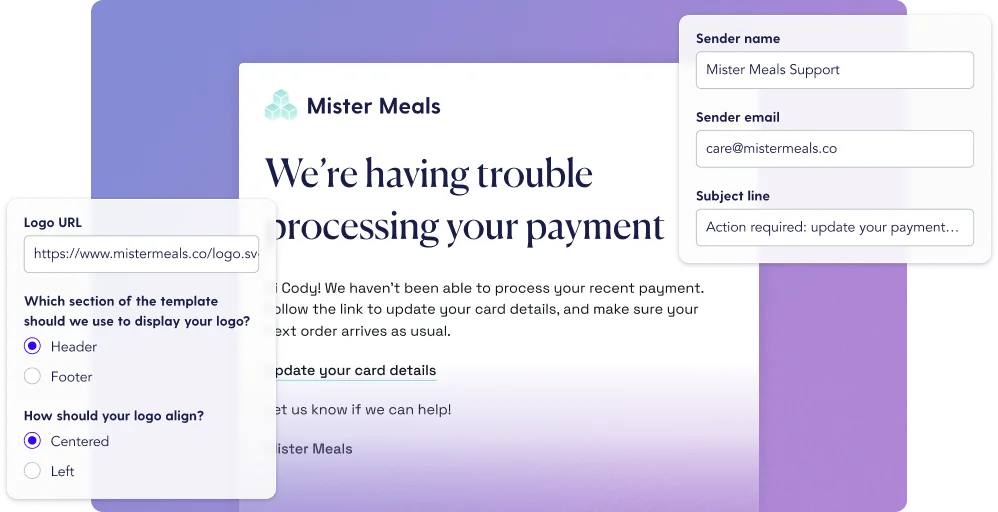

Seamless, on-brand communications

Failed Payment Recovery lets you send timely notifications equipped with templates that increase in urgency based on where a failed charge is in recovery. You can even take full control of your notifications by customizing the copy, branding, and HTML and CSS.

Smarter analytics

Use Failed Payment Recovery’s in-depth analytics to understand how and when your payments are recovered. Track your aggregate recovery rate and revenue saved, analyze the daily patterns of when and how your charges are recovered, and track how often payments are recovered via reattempts and payment method updates.

What to do if you’re losing revenue and subscribers

Many brands don’t realize how big an impact payment failures can have on their customer retention. And many of those that do still haven’t implemented smart solutions like Recharge’s to automate and optimize payment recovery processes. Top brands have recovered up to 50% more revenue from failed payments after switching to Failed Payment Recovery.

In a competitive landscape, it’s critical to actively seek out solutions that enhance your customer LTV and MRR. Don’t let involuntary churn erode your hard-earned subscriber base and revenue—implement a smart solution like Failed Payment Recovery to make payment failures a problem of the past.