A good loyalty program fosters repeat orders and long-term brand attachment, making it an important tool for many brands. However, for subscription-first brands, loyalty needs a different approach.

Traditional loyalty programs aim to re-engage customers and encourage them to make another purchase. Subscription brands, on the other hand, already have that next-order commitment built in, so the focus of their loyalty programs is different: They aim to dissuade customers from opting out by giving them compelling reasons to stay subscribed.

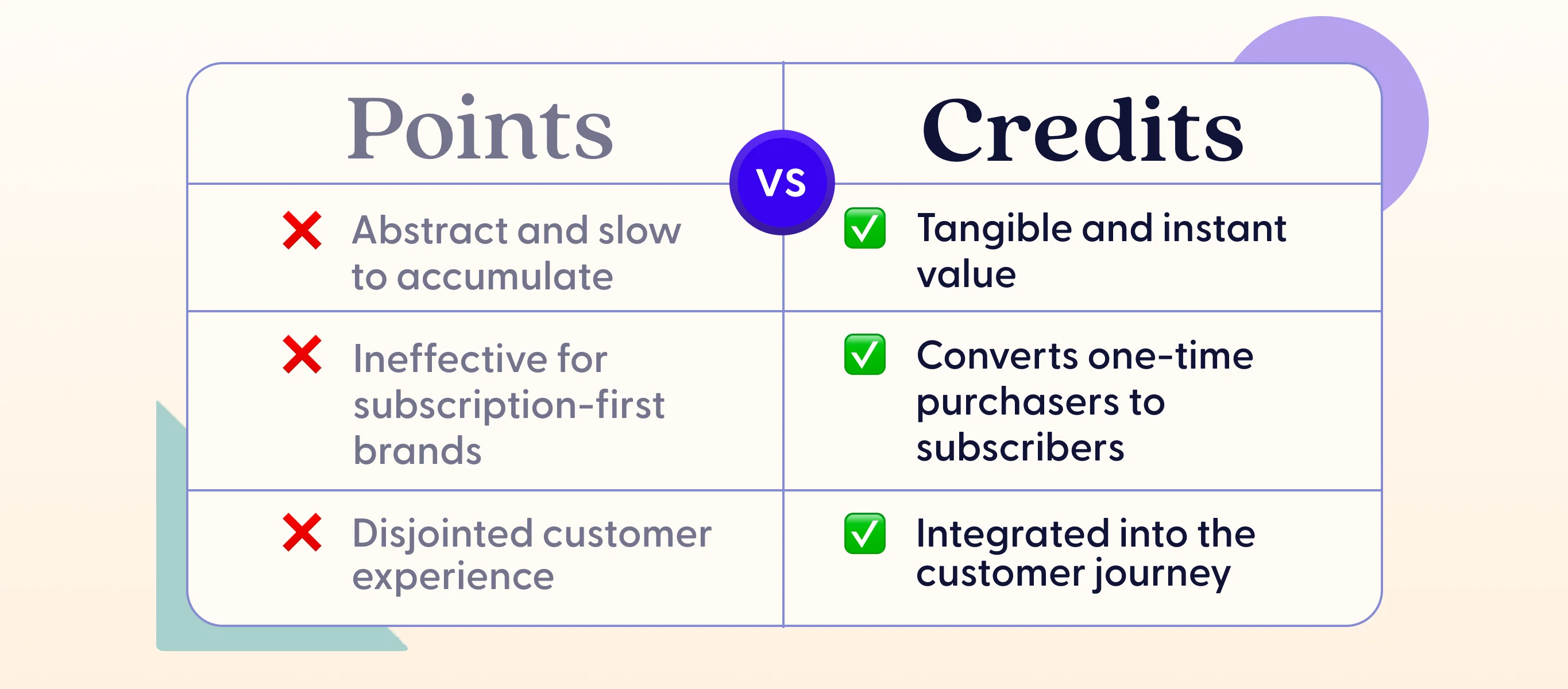

Many loyalty programs, though, are outmoded and coming up short. Points systems are a long-time favorite of brands; they’re also confusing and abstract for customers, presenting as many obstacles as incentives.

The answer? Credits—instant, cash-back-like rewards to spend on future orders. Awarded as a simple percentage of each purchase, they’re easy to grasp and even easier to spend.

Let’s dive into how credits deliver better loyalty experiences for brands and consumers.

The problem with points

Loyalty points are among the most common rewards, offered on everything from morning coffee to airline tickets. But they’re not the right fit everywhere.

Why? Points are frustratingly opaque. Their value is hidden and abstract, and it can even vary when redeemed for different rewards. That can help brands control incentives more tightly, but it makes it difficult for customers to understand what they’ve earned and can erode their trust in the program.

Worse, points can feel slow. 70% of customers abandon rewards because it takes too long to earn enough points to redeem, which is exactly the opposite of the intended effect.

Points programs are also typically separated from the buying process. Customers are forced to log into a different page, redeem their points for a discount code, copy that code, and then return to the brand’s main site to shop. This disjointed experience makes the process of receiving a reward feel time-consuming and not worth the effort.

Different solutions for different industries

These shortcomings aren’t an issue for every brand. Airlines and hotels, for example, are built on infrequent, high-dollar purchases. Their customers may be comfortable accumulating points over longer periods, and the exchange rate is more consistent when points can only be used toward one type of purchase anyway.

But subscription retail is built on relatively frequent, inexpensive purchases, and many brands offer a wide array of products. For customers to trust and use a rewards program, it needs to be intuitive and immediately useful—like in time for the very next order.

Why credits keep customers coming back

In the subscription world, loyalty programs make it second nature for customers to use your products. Credits offer clear, trackable rewards that can save up over time (or be cashed in instantly), making each new order an easy choice and one that builds long-term loyalty.

They’re tangible, intuitive & motivational

Points are abstract—a number with a hidden value. Credits are crystal-clear and ready to use right away, and their cash back-like nature makes them feel more rewarding and less arbitrary.

Customers can also save them up for bigger purchases, with auto-renewed orders providing a steady stream of credits. That keeps them engaged without hurting your margins or inventory—and the accumulated savings gives them another valuable reason to stay subscribed.

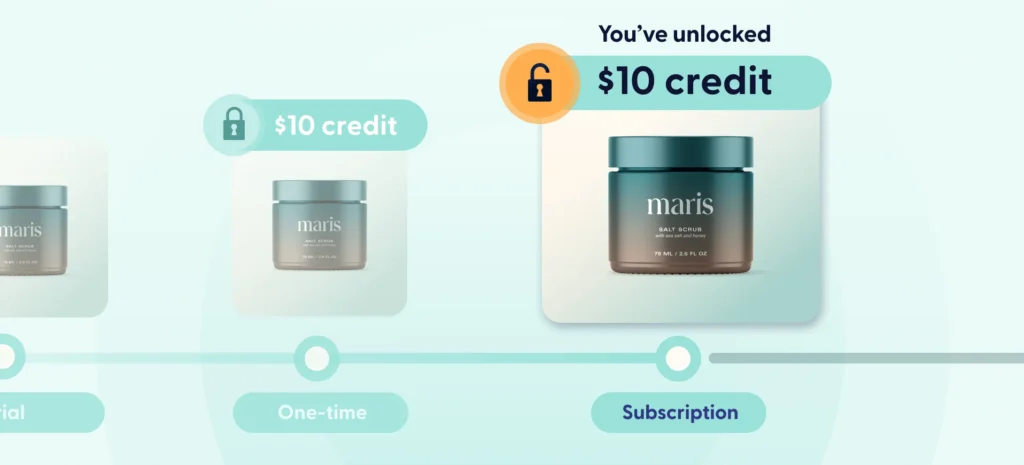

They make subscriptions appealing

Though any type of customer or order may earn credits, brands also have the option of making credits redeemable only by subscribers. That provides a strong incentive for one-time buyers to upgrade to subscriptions and unlock the value they’ve earned.

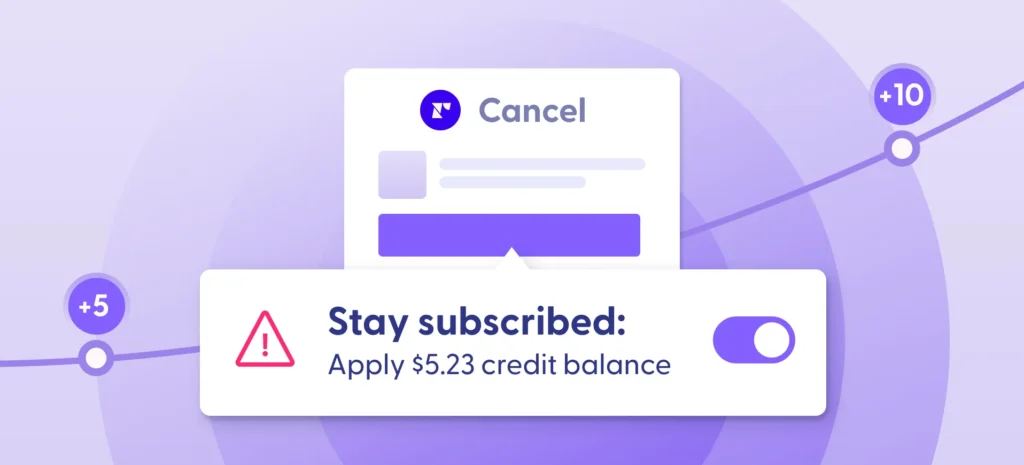

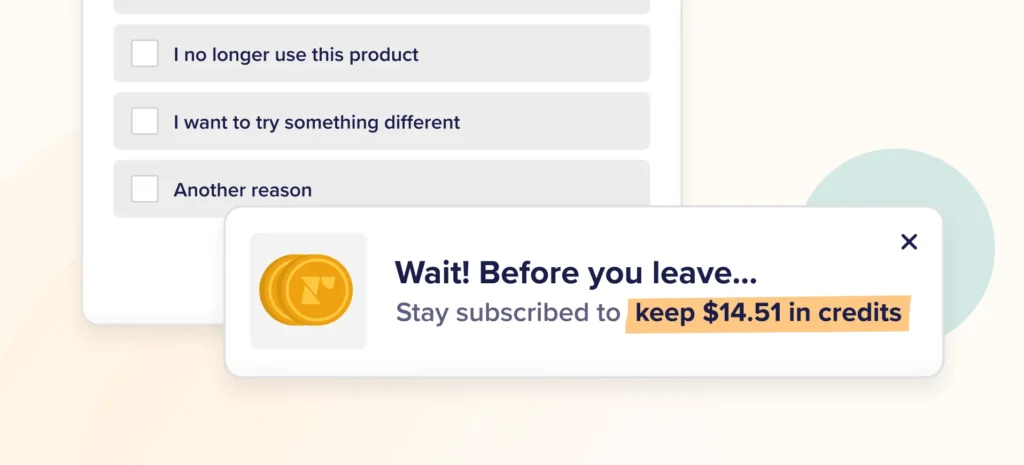

They deter cancellation

A key moment for brands is when customers are most likely to churn, often after their second or third order. Offering credits on every purchase helps customers build up meaningful credit balances by these milestones, giving them a clear reason to stick around.

For example, offering 3% cash back on each order means that, by their second or third order, customers will have accumulated $5.10 to $7.65 in credits, assuming an average order size of $85. Reaching this $5-$10 credit sweet spot can make customers think twice about canceling, as they won’t want to lose the valuable rewards they’ve earned.

Make the switch to credits

Recharge’s Rewards uses a modern, customer-centric approach to loyalty programs that outperforms traditional points systems. Tangible, easy-to-understand rewards like credits create an immediate sense of value for the customer.

This approach is particularly effective in a subscription model, where maintaining convenience and preventing churn is crucial. As customers accumulate credits, they become more likely to keep ordering, knowing they’ll miss out on real value and benefits if they cancel.

Credit-based loyalty programs benefit both brands and customers by building long-term relationships built on clear, meaningful rewards.