4 customer retention strategies to extend subscriptions & build customer loyalty

Published June 2024

Published Jun 2024

Updated January 2026

Updated Jan 2026

7 min read

AI Summary

Customer retention is at the forefront of every ecommerce brand’s strategy right now. When customer acquisition costs five times as much as retention, most businesses will stretch their resources further by cultivating relationships with the customers they already have than by chasing after new ones.

Customer retention is at the forefront of every ecommerce brand’s strategy right now. When customer acquisition costs five times as much as retention, most businesses will stretch their resources further by cultivating relationships with the customers they already have than by chasing after new ones.

But retention is also a different beast from acquisition—it requires a multifaceted approach to different aspects of the customer experience. And with different brands favoring so many different retention strategies, it can be hard to know where to focus your efforts.

In this blog, we’ll walk through some of our most trusted customer retention strategies, including:

- Loyalty programs

- Personalized cancellation alternatives

- Automated failed payment resolutions

- Lapsed subscriber re-engagement

Like what you see? Take a look at Recharge’s Retain package, our suite of offerings designed to help you build lasting relationships with customers.

Our favorite ways to retain customers

Expand your customer retention strategy with these proven tactics.

Thank loyal customers with rewards

They’re no secret—brands in every retail segment have used rewards programs to earn customer loyalty for years. This tried-and-true approach could be the perfect addition to your customer retention strategy, providing incentives that get existing customers to their next order every time.

Rewards programs come in lots of different forms:

- Points-based programs that reward customers with points to redeem for discounts on future purchases. These are often ideal for consumable products that are replenished regularly, adding a layer of variety to a subscription.

- Tiered programs that reward customers with freebies or points when they pass certain milestones, like the number of orders placed. These can be the perfect option for something like a skincare or nutrition regimen that need time to start working—staggered rewards at key points encourage subscribers to stick around long enough to see results.

- VIP programs that provide special perks and benefits, like access to members-only events, new releases, or opportunities for input and feedback. These are a versatile option that can be blended with other setups for unique results. And more detailed customer feedback will help you enhance your products, too.

No one-size-fits-all option

Whichever loyalty program you choose for your business, make sure it’s flexible enough to adapt to your brand and customers. Recharge’s Rewards feature is designed to get better over time—its built-in A/B testing capabilities help you zero in on the most effective incentives for customer retention.

Plus, its integration throughout the customer experience means you can even use remaining rewards to try to sway customers when they move to cancel (more on that below).

Alternatives to cancellation

Eventually, some customers will end their subscriptions. There’s no way around that—churn is an inevitable part of subscription commerce.

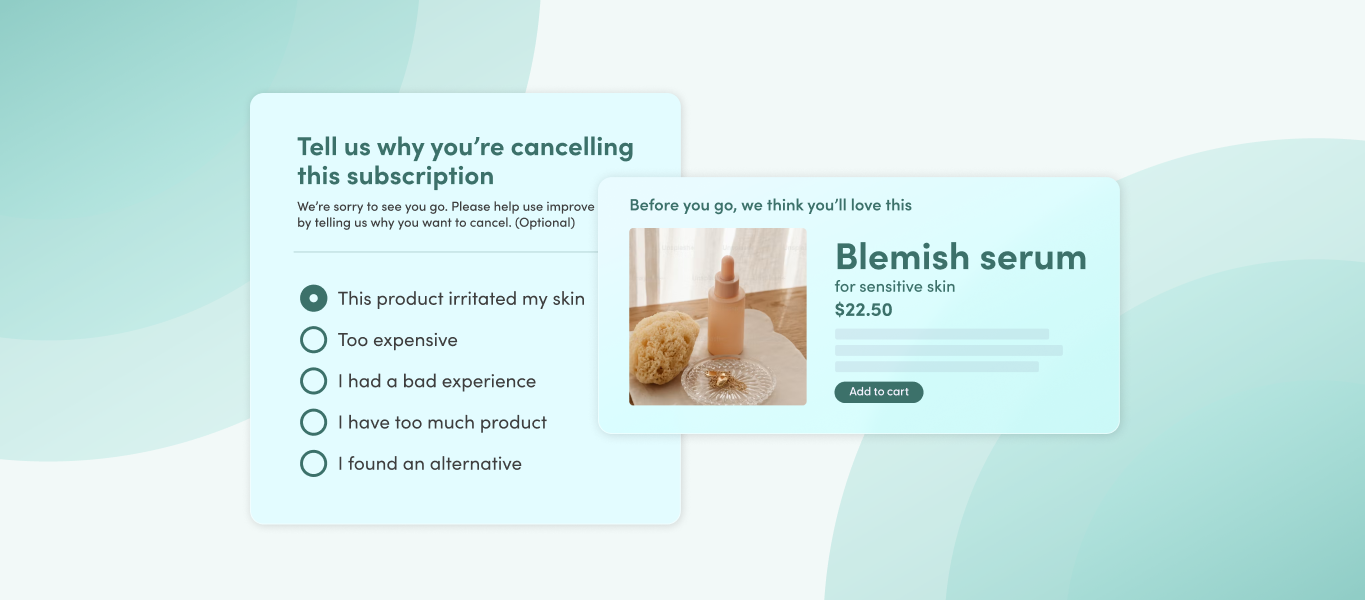

But not every cancellation attempt needs to be the end. Sometimes customers cancel permanently due to temporary circumstances, or to solve a problem they don’t realize has another solution. That’s where personalized cancellation alternatives come in.

It’s simple: When a customer initiates cancellation, just check on why, then offer a tailored (and less permanent) solution. Too much product on hand? Skip or delay the next order. Extended trip out of town? Pause the subscription, to be resumed when ready. Trying to save money? Here’s a one-time discount. Not sold on your product of choice? Try these other options customers like you love.

This approach doesn’t just prevent losses, it turns them into wins—solving problems for customers extends their subscriptions and results in even higher customer satisfaction (and thus customer retention) than before.

A built-in solution from Recharge

Recharge’s Retain suite includes Cancellation Prevention, a solution that does all this out of the box. Your brand can use it to build custom exit surveys and configure alternative offers for different cancellation reasons.

And like lots of Recharge tools, it comes with built-in testing capabilities and analytics, so you can rest assured that you’re maximizing your customer retention rate.

Fix failed payments

Churn may be inevitable, but it’s not always intentional. In fact, passive, or unintentional, churn is relatively common—and since it happens to customers who still value your services and products, addressing it can be a surefire way to keep subscribers around and revenue flowing.

Passive churn is usually the result of one of a handful of payment-related reasons, like insufficient funds, expired cards, or processing errors. And its solutions are often straightforward on paper: notifying customers of payment info issues, reattempting failed payments, etc.

But even among brands that have solutions to passive churn, those solutions are often inadequate. They may simply reattempt payment over and over without addressing the root cause, or they may provide cryptic, confusing communication to customers that doesn’t lead to a resolution. When choosing a passive churn solution, be sure to invest in one that addresses the issue intelligently and can actually increase customer retention.

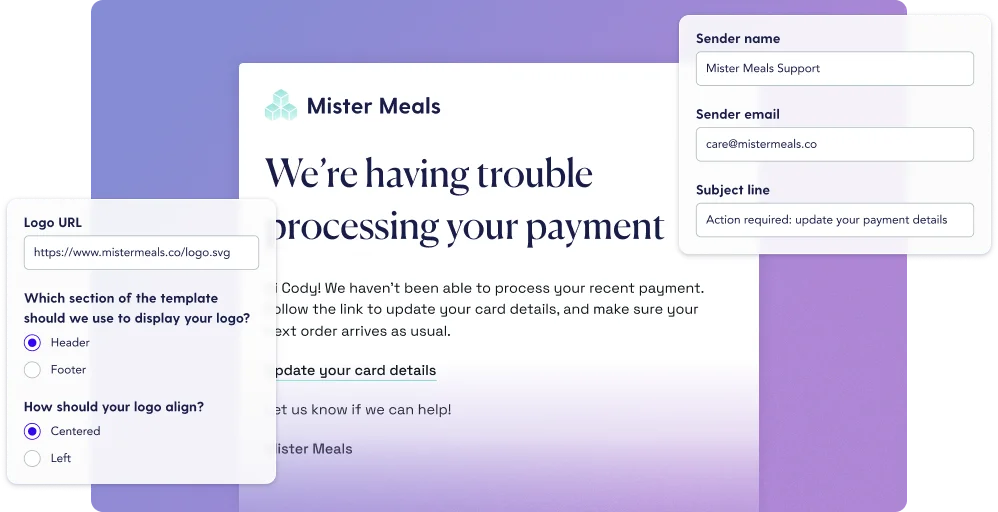

Try Failed Payment Recovery from Recharge

Also included in Retain is Failed Payment Recovery, which Recharge designed from the ground up to tackle the most common problems with passive churn solutions. It uses a custom AI- and machine learning-based smart retry policy to reattempt payment processing at the times most likely to result in success, and the communications it sends to customers can be fully branded and customized.

Re-engage lapsed subscribers

While customer acquisition and retention are often discussed as separate concepts, they intersect at one notable source of new subscribers: former subscribers.

That’s right—a surprising number of customers are ready to return for the right offer. And since they’re already familiar with your brand and products, they typically require less education than brand-new customers, making them a cost-effective source of subscriptions.

The trick is personalization. Someone who’s already tried your products and ended their subscription isn’t likely to be won over again by the same approach that earned their business the first time—you’ll need more finesse.

Luckily, you know a bit more about them now than you did when they first began shopping with you. You have information about their shopping habits, budget, and preferred products. Use that! When you launch a new product, advertise it to former subscribers with a history of enjoying similar products. If you lower the price of an item that many subscribers have cancelled in the past due to costs, send them an email about it—you may earn yourself a few more customers.

Coming soon to Retain: Win Backs

Recharge’s platform is built to enable deep personalization and strong customer relationships. Win Backs, an upcoming component of the Retain suite, is no exception. Brands will be able to use it to craft personalized landing pages that showcase compelling offers on products that subscribers are likely to love, making new customers out of old ones.

Boost customer retention with a comprehensive strategy

Retaining customers may not always be simple, but a multifaceted strategy will keep your customer retention rate high and growing higher.

- Turn curious shoppers into repeat customers with a loyalty program that incentivizes them to get to their next order (and maximizes customer lifetime value to boot).

- When current customers move to cancel, offer alternative solutions that they’ll find even more effective.

- Monitor payment processing and implement a smart, automated system to fix issues.

- Don’t rule out former subscribers—send them personalized offers that can renew their enthusiasm.

With the right combination of systems in place, customer retention can turn from a problem into an advantage.

Categories