How to start accepting credit card payments

Published December 2022

Published Dec 2022

Updated December 2022

Updated Dec 2022

9 min read

AI Summary

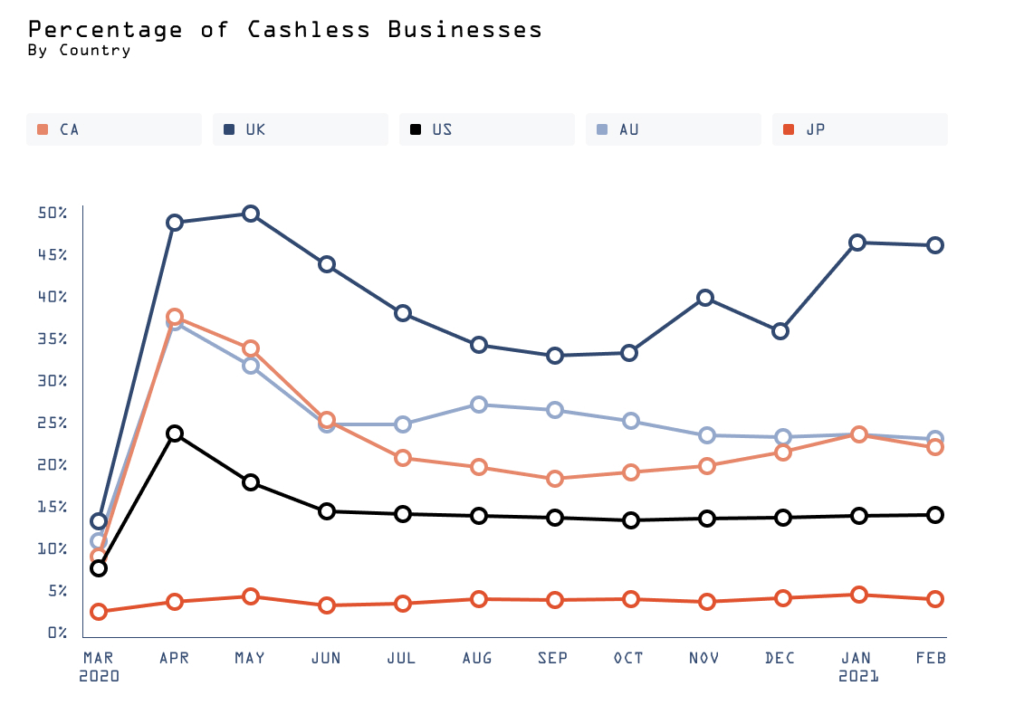

Cashless payments have become much more common since the Covid-19 pandemic. Square Inc. reports that from March 2020 to March 2021, the share of cashless businesses in the United States more than doubled. Small business owners who don’t accept credit card payments risk missing out on significant benefits, including faster transactions and increased customer satisfaction.

Cashless payments have become much more common since the Covid-19 pandemic. Square Inc. reports that from March 2020 to March 2021, the share of cashless businesses in the United States more than doubled.

Small business owners who don’t accept credit card payments risk missing out on significant benefits, including faster transactions and increased customer satisfaction.

Wondering how to start accepting credit card payments? There are plenty of affordable options, including some that work both in-store and online. Read on to see which option is right for your business.

Reasons to accept credit card payments in your store

Whether you run an online shop, a brick-and-mortar establishment, or a hybrid business, accepting electronic payments can help you compete for customers who expect convenience at every turn.

Let’s walk through some of the benefits of accepting credit card payments.

Customers may spend more

Multiple studies confirm that people using a card spend more than those using cash. The reasons vary, but for some, cards allow for impulse purchases. They may buy the item they need and throw in a bonus purchase since they’re paying the bill later (along with their monthly fees).

Payments are resolved quickly

Credit card companies resolve payments quickly. Typically, you’ll see the funds in your account within days. While that’s still more time than it would take to accept cash, you’ll avoid the hassles of cash transactions.

Other payment methods, like accepting checks, come with their own risks. While writing bad checks comes with significant consequences (including jail time in some states), some people still do it. If you’re stuck with a bounced check, getting your money can be incredibly time consuming.

If you allow layaway programs, getting customers to pay their bills with cash can be equally difficult. Sending invoices, contacting collections, and other related tasks take time away from more profitable activities.

You can track your customers

People who pay with cash can stay anonymous. This makes differentiating repeat buyers from first-time shoppers tough, and you can’t effectively market loyalty programs, special deals, or referral programs.

Credit card payments create a trackable customer history. You can use that data to build your business and create even more effective ways to deliver exceptional customer service and retain more customers.

You’ll keep up with the competition

Running a small business in a tight market isn’t easy. If you don’t accept credit card payments but your competitors do, you might look like a dated business that doesn’t keep up with modern technology. That could cost you valuable credibility and potential new customers.

You’ll open the door to online sales

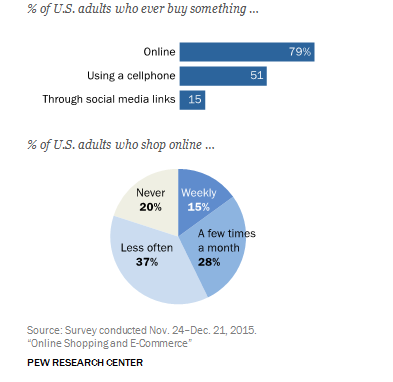

About 8 in 10 Americans are online shoppers. Some use their computers, but others use their smartphones or social media apps.

No matter what type of business you own, you can likely find more customers by selling your products and services online. To do that, you’ll need to enable credit card processing.

Ways to accept credit card payments

There are a number of ways to accept credit card payments. To start, you’ll need to set up a merchant account and get a payment gateway service.

A merchant account is a type of commercial bank account that enables businesses to make, accept, and process credit and debit card payments.

A payment gateway is a piece of software that processes transactions when customers use their Visa, Mastercard, or other card networks.

The partner you choose can help you get started and walk you through all the steps.

Once those two steps are taken care of, it’s time to determine how you’ll capture credit card transactions.

POS (point of sale) system

Many POS systems will include a payment gateway, and may come with additional features, including:

- Receipts: Customers use paper and digital receipts to keep track of their books.

- Code scanners: Some POS systems can scan coupon codes or QR codes.

- Tracking: Some POS systems can interact with your inventory control system, ensuring you always know how much you’ve sold and how much product you have left.

- Card readers or terminals: This bit of technology allows customers to hand over their cards, and the payment request moves from your checkout line to the credit card payment company.

Most POS systems can read all sorts of cards, including those from American Express, Discover, Visa, and more. Some can also read chip cards, allowing customers to tap instead of sliding their cards.

QR codes

A QR code is a type of barcode readable by most cellphones. When users scan a QR code with their smartphone’s camera, a payment portal opens up, which customers can use to complete the transaction.

Contactless payments are incredibly popular, as they don’t require customers to hand over their cards to interact with potentially germ-laden portals, or dig through their bags to find their card. Every bit of friction you can remove helps improve your customer experience.

Quick-service restaurants, retail, and hospitality businesses are the main QR payment drivers right now, but many businesses can benefit from this payment option.

Online systems

An online payment gateway allows you to accept credit card payments online. When people visit your online store, they make a purchase and enter card information into your payment gateway, which verifies funds, completes the transaction, and transfers the money to your account.

A customer’s account and the business account don’t work together in this system. Rather, the gateway connects them.

Mobile phone processing

While payment terminals are safe and effective, they can also be bulky and hard to transport from place to place. If you’d like to accept payment information on the go (for example, asking restaurant servers to process cards tableside), you’ll need a mobile payment device.

A mobile card reader attaches to a device like a phone or a tablet. Bluetooth keeps the device connected, and payment apps process the money.

The best gateways for credit card payments

Remember that a payment gateway transfers payment data from your customer’s account to yours. Many payment service providers are available. To choose the right one for your business, this requires digging into available features, uses, transaction fees, and pricing.

There are several partners to consider as you learn how to process payments from credit cards. These include:

PayPal

PayPal is one of the oldest and most robust gateways available for small business owners. Use it to accept credit card payments in an online shop, or leverage PayPal’s Venmo option and accept digital payments from anywhere, including brick-and-mortar shops. PayPal also uses QR codes, and a buy-now-pay-later option could entice your customers to buy more now.

Stripe

Stripe is designed with customization in mind, so small business owners can make this gateway work to fit their unique needs. Use Stripe to accept payments online, or take payments in person through a customized credit card terminal with Stripe Terminal.

Stripe features include custom invoices, subscription setups, and international payment processing. They also offer a mobile wallet function and buy-now-pay-later financing.

Square

Square offers a robust POS system, which allows retailers to accept credit cards at checkout. Square allows people with few coding skills to set up a website to accept online payments, or it can interact with an existing site to take payments. Square is particularly efficient for companies hoping to set up subscription services.

Google Pay & Apple Pay

Both Google Pay and Apple Pay offer mobile credit card options. Consumers set up the apps with their credit card data, and when they are ready to pay, they use their device rather than their card.

Apple Pay works on newer iPhone and iPad models, while Google’s technology is workable on older devices. Google’s setup is slightly more secure, as all data is stored on Google’s servers. But Apple’s use of tokens during setup is also much more secure than using traditional cards.

Authorize.net

Authorize.net is owned by Visa, but the technology accepts payments from a wide range of credit cards. In general, it’s best for companies to connect Authorize.net with a Chase business bank account.

Authorize.net offers online payment options, POS connections (including mobile card readers), and mobile payment options. Authorize.net also provides a next-day payout feature, making this one of the fastest ways to get paid.

Pave the way for long-term customer relationships

Whether your customers visit you in person or online, they’ll appreciate the speed and flexibility that comes with using a card.

Choosing the right partner is critical, and the ideal choice will vary depending on your business setup and needs. Take time to investigate every company carefully before making a commitment.

FAQs on accepting credit card payments

Do payment gateways only accept credit cards?

No. Some payment gateway options allow customers to write digital checks, and most allow customers to use their debit cards as well as their credit cards.

Since all gateways are different, be sure to ask a vendor about your payment options before you sign up.

How can customers make payments from international cards or accounts?

Some types of credit cards (including Mastercard and Visa) are accepted worldwide. But sometimes, transactions made in another country might appear fraudulent to credit card companies. For example, if you live in Australia and suddenly your card is being used in India, the credit card company might freeze your account until you verify that you’re the one behind the charges.

What’s the standard transaction fee for processing credit card payments?

Unfortunately, there is no standard transaction fee that applies to every business and industry. Companies may charge more depending on how many transactions you process, how many types of payment you accept, and where your business is located.

Before you choose a partner, ask about your fees in detail. Most companies offer estimates, so their potential clients can make smart decisions.

Categories